Kitchen Chimney Teardown & Should Costing

Key Points to Consider While Conducting Tooling Should Costing

Comprehensive Guide to Should Costing in the Automotive Industry

This article is an opinion piece from our engineers working on should costing of various types of vehicles and their learnings on methods, tools and challenges in this stream of engineering. We have taken the liberty of mentioning some products and brands operating in this market which should not be taken as product advise or recommendation and only as our own opinion from our own experiences.

The automotive industry operates in a highly competitive landscape where cost efficiency can be the difference between success and failure. In this scenario, Should Costing has emerged as an essential methodology for manufacturers to better understand and manage costs, particularly when dealing with suppliers and complex products like automotive electronics. This article provides a thorough overview of should costing, its methodology, its application in the automotive sector, and a comparison of different should costing software platforms like Apriori (or similar tools from various PLM Vendors) and xcPEP. By understanding the intricacies of should costing and leveraging the right tools, automotive companies can gain a competitive edge.

What is Should Costing?

Should Costing is a cost estimation technique used to calculate the optimal cost of a product, based on the detailed breakdown of raw materials, labor, overhead, and other factors involved in its production. Unlike traditional costing, which relies on supplier quotes or historical costs, should costing aims to determine what a product should cost if produced efficiently. This process empowers companies to negotiate better prices with suppliers, reduce production costs, and enhance profitability.

Key Objectives of Should Costing

- Identify Cost Drivers: Understanding the specific factors that contribute to the cost of a product, such as raw materials, labor rates, machine hours, and overhead.

- Cost Benchmarking: Comparing the calculated cost of a product with supplier quotations or industry standards to identify potential savings.

- Support Negotiations: Armed with detailed cost breakdowns, companies are better positioned to negotiate prices with suppliers.

- Optimize Design: Should costing can highlight opportunities to redesign products for cost savings, especially by eliminating unnecessary materials or steps.

- Predict Future Costs: By analyzing historical data and current market trends, should costing helps manufacturers anticipate future cost fluctuations and plan accordingly.

Should Costing Methodology

The should costing process follows a structured methodology that involves analyzing all the components and processes required to manufacture a product. Here’s a detailed breakdown:

Breakdown of Product Components

The first step in should costing is to break the product down into its individual components. In the automotive industry, this could include everything from the metal frame and engine parts to smaller items like bolts and connectors, as well as complex electronic systems. This detailed breakdown helps ensure no aspect of the product is overlooked.

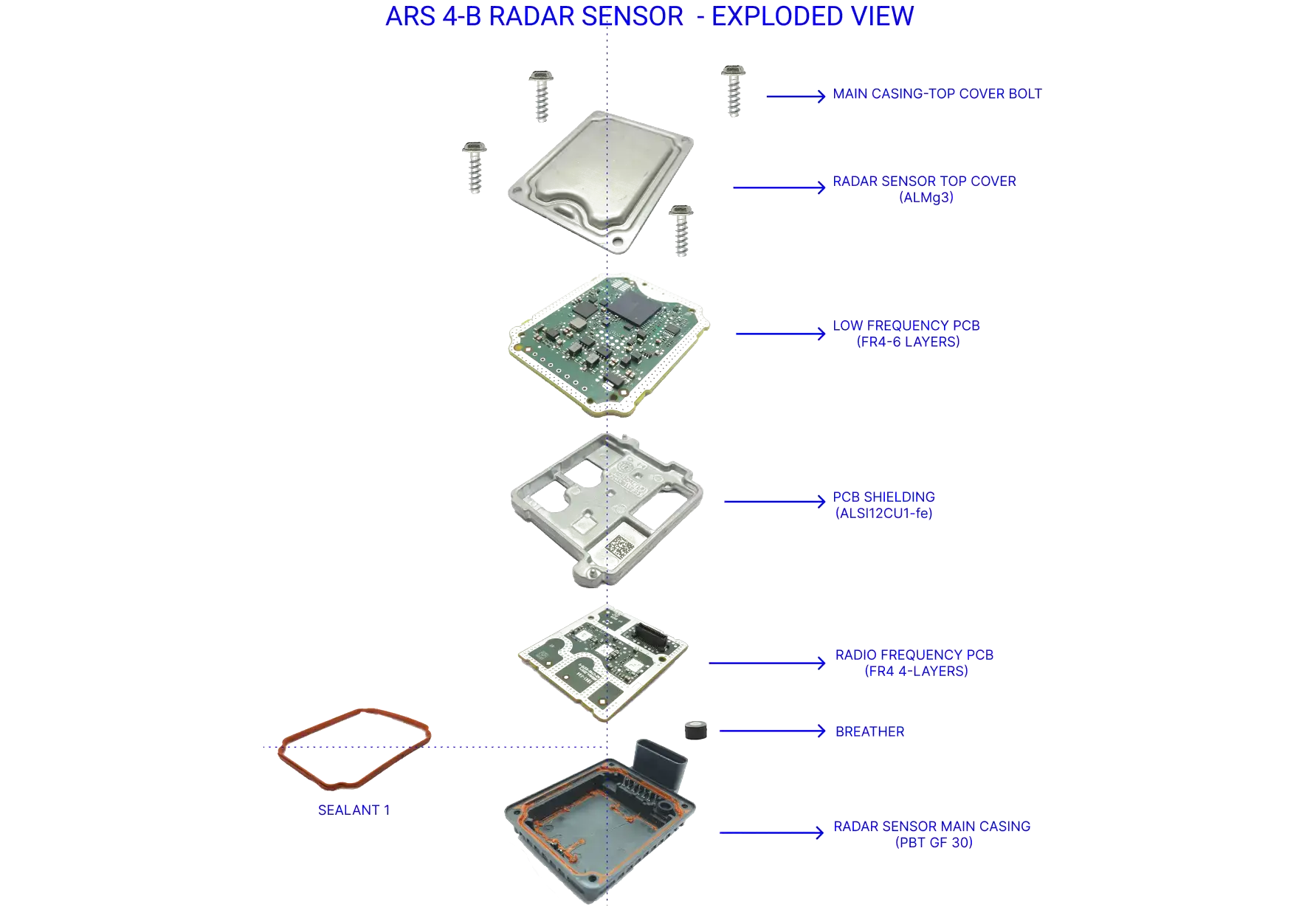

The diagram below shows the exploded image of a radar sensor used in ADAS system of an electric vehicle.

Material Costs

Next, the materials used to manufacture each component are analyzed. In automotive manufacturing, materials like steel, aluminum, plastics, and electronic components like semiconductors are critical. Should costing considers not just the cost of raw materials but also their sourcing, availability, and market fluctuations. Understanding the material cost is crucial when negotiating with suppliers or evaluating alternatives.

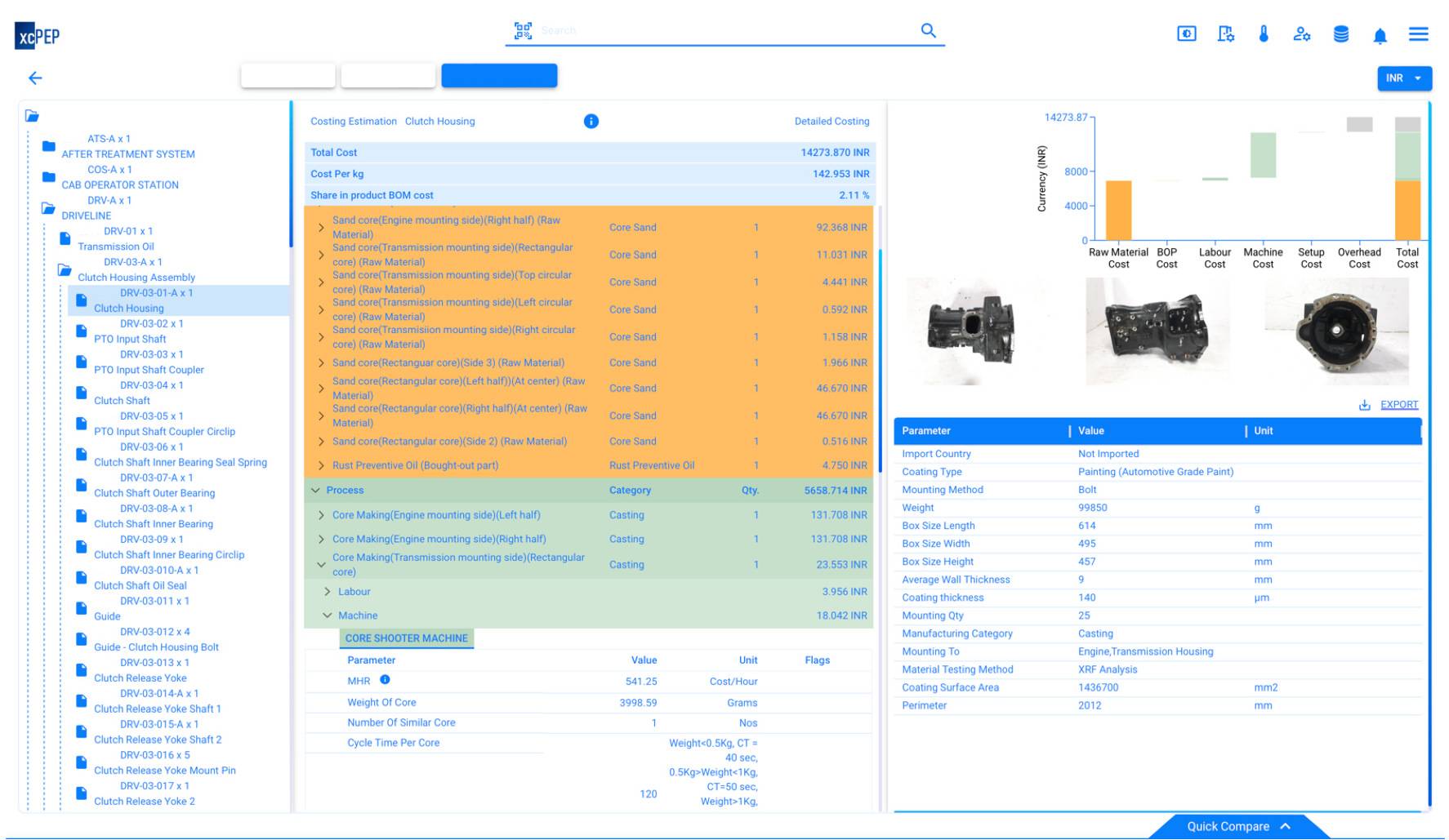

Above screenshot from a demo costing of a casting part shows various steps in material and process cost estimation in xcPEP.

Manufacturing Process Cost

The labor cost for each component or process is calculated based on labor rates, skill levels required, and the time needed to complete each task. In regions where labor costs fluctuate or when working with international suppliers, this becomes a key consideration in should costing analysis. In automotive production, labor costs can vary significantly depending on the complexity of the task, ranging from high-skilled processes like engine assembly to lower-skilled work such as material handling.

In addition to labor, the overall manufacturing process cost includes machine costs, which account for the operation, maintenance, and depreciation of equipment. In automotive manufacturing, these processes might include stamping and welding for body panels, or intricate assembly work for electronic components. By analyzing both labor and machine costs, the goal is to identify inefficiencies or areas where automation could reduce expenses, improving the overall cost structure.

Tooling Cost

Manufacturers spend a significant portion of the development costs for vehicles on part tooling, which is determined based on projected manufacturing volumes. In xcPEP we have a list of 100K+ tools cost data, we conduct meticulous Should Costing of various types of tools (based on category of parts), including soft tools and high-life tools, considering the varying lifespans of parts, including prototypes. The cost of the tools is subsequently allocated through individual component Should Costing. However, our xcPEP platform also offers the flexibility to create alternative variations using our Multiple-Scenario-Costing feature. This feature enables the amortization of tooling costs, taking into account factors such as depreciation and tool ownership with the suppliers.

Overhead Costs

Overhead costs include utilities, rent, equipment depreciation, and other indirect costs associated with manufacturing. These are allocated proportionally to each product based on its consumption of resources. In automotive electronics manufacturing, overheads can include the costs of high-tech machinery required for component fabrication.

Logistics and Supply Chain Costs

Logistics play a significant role in the final cost of automotive components, especially as companies increasingly source from a global supply chain. Shipping costs, import duties, and tariffs are considered in the should costing analysis to give a full picture of what the component should cost when it reaches the manufacturing plant.

Comparison with Supplier Quote

Finally, the estimated cost is compared with supplier quotes. If the supplier’s quote significantly exceeds the calculated should cost, it becomes an opportunity for negotiation or exploring alternative sourcing options.

Application of Should Costing in the Automotive Industry

Mechanical Components

Mechanical components, such as steel, cast iron, plastic, and rubber parts, are subject to rigorous cost analysis in the automotive industry. Should costing enables manufacturers to break down the cost of each component and compare it against industry benchmarks. For instance, a car manufacturer can analyze the cost of a steel body panel by evaluating the raw material (steel), labor required for stamping the panel, and overhead costs tied to the machinery involved. Similarly, should costing can be applied to cast iron engine parts, plastic interior features, and rubber seals, ensuring that each material and process is optimized for cost efficiency.

Automotive Electronics

Automotive electronics present unique challenges in should costing due to their complexity and high value. Components like infotainment systems, ADAS (Advanced Driver Assistance Systems), and powertrain control modules are typically sourced through multi-tiered supply chains, with limited transparency from vendors. Furthermore, the rapid pace of technological advancement means that material and labor costs fluctuate frequently.

In this context, should costing provides a framework to estimate the optimal cost of electronic components. For instance, manufacturers can use should costing to break down the cost of a semiconductor used in a powertrain control module, considering factors like silicon wafer costs, fabrication, and assembly labor. This allows for more accurate negotiations with suppliers and helps identify areas where costs can be reduced—whether by redesigning the module, sourcing from a different supplier, or adopting a new manufacturing technology.

Supply Chain Optimization

Automotive electronics present unique challenges in should costing due to their complexity and high value. Components like infotainment systems, ADAS (Advanced Driver Assistance Systems), and powertrain control modules are typically sourced through multi-tiered supply chains, with limited transparency from vendors. Furthermore, the rapid pace of technological advancement means that material and labor costs fluctuate frequently.

In this context, should costing provides a framework to estimate the optimal cost of electronic components. For instance, manufacturers can use should costing to break down the cost of a semiconductor used in a powertrain control module, considering factors like silicon wafer costs, fabrication, and assembly labor. This allows for more accurate negotiations with suppliers and helps identify areas where costs can be reduced—whether by redesigning the module, sourcing from a different supplier, or adopting a new manufacturing technology.

Challenges in Scaling Should Costing Across an Organization

While should costing offers clear benefits, implementing it across a large organization—especially in the automotive sector—presents significant challenges:

Data Management Across Multiple Departments

Automotive manufacturers often have multiple departments, each using different costing methodologies and tools. Without standardization, it becomes difficult to track costs accurately across the organization. For example, the cost model used by the engine assembly team may differ from the model used by the electronics team, making it challenging to compile a holistic view of production costs.

Frequent Updates

In industries where material costs fluctuate regularly, such as steel or semiconductors in the automotive sector, cost models need to be updated frequently. For large organizations, manually updating thousands of cost models on a monthly or quarterly basis is a daunting task. Without real-time updates, manufacturers risk making decisions based on outdated or inaccurate data.

Handling Large Datasets

Automotive manufacturers deal with massive datasets, including thousands of parts, suppliers, and production processes. Managing this volume of data using traditional tools like Excel or basic costing software becomes unmanageable at scale. The challenge lies not only in storing and organizing the data but also in making it actionable for decision-makers across different teams.

Identifying Cost Reduction Opportunities

In a large automotive company with multiple product lines and production facilities, identifying specific areas for cost reduction is challenging. Without advanced data analytics, opportunities for savings may go unnoticed, especially when evaluating costs across suppliers, locations, or materials.

Should Costing Software: Comparing xcPEP and Apriori/PLM Costing Modules

To overcome these challenges, many companies turn to specialized should costing software. Tools like Apriori or its analogues from various PLM vendors and xcPEP offer a range of features designed to streamline the should costing process, but they cater to different needs. Below, we compare the two platforms and explain why xcPEP is uniquely suited for large-scale, real-time should costing in the automotive industry.

Apriori Or Similar CAD-Based Costing Software From Various PLM Vendors

Apriori is a popular should costing tool that integrates with CAD systems, allowing users to generate cost estimates directly from product designs. It’s primarily used by design engineers to assess the cost implications of different design choices. Various PLM vendors have made their own software mimicking Apriori's capabilities.

However, while Apriori excels at providing quick cost estimates for design iterations, it falls short when it comes to scaling cost management across an entire organization. The software is optimized for predicting manufacturing steps from CAD models, which limits its granularity when it comes to mapping manufacturing processes or considering fluctuating material costs and labor rates.

Key Limitations of Apriori and its analogues:

- Focuses on design engineers rather than cost engineering teams. Suitable for iterative process of designing lower cost parts through cost delta analysis.

- Limited granularity in mapping manufacturing inputs and processes.

- Struggles with real-time updates for material and labor costs.

- Not suitable for Should Costing suitable for commercial negotiations and purchase decision making.

xcPEP: The Purpose-Built Should Costing Software

xcPEP, developed by Advanced Structures India, is designed specifically for cost engineers and procurement teams in industries like automotive. Unlike CAD-based tools, xcPEP offers a more granular approach, allowing users to map every detail of the manufacturing process, from raw materials to overhead and labor costs.

xcPEP is built to handle large datasets, making it ideal for organizations with complex supply chains and multiple product lines. Its ability to standardize costing models across the organization ensures consistency and accuracy in cost data. Furthermore, xcPEP supports real-time updates for material prices, supplier rates, and labor costs, ensuring that your cost models are always current.

Key Advantages of xcPEP:

- Granular process mapping of cost drivers.

- Real-time updates for material, labor, and overhead costs.

- Standardization of costing models across large organizations.

- Seamless collaboration between procurement, cost engineering, and finance teams.

- Automated raw material price indexing and scenario analysis.

- Advanced analytics to identify cost reduction opportunities.

In summary, while Apriori serves as a useful tool for design engineers, xcPEP is better suited for cost engineering teams in large automotive companies, particularly those looking to manage costs at scale.

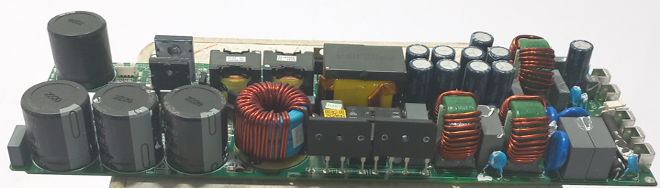

Automotive Electronics: A Case Study in Should Costing Challenges

As automotive technology evolves, electronics have become an integral part of modern vehicles. From infotainment systems and ADAS to powertrain control modules, automotive electronics play a key role in vehicle performance and customer experience. However, these components also present unique challenges in should costing.

Complex Supply Chains

Automotive electronics are often sourced from global supply chains, with limited visibility into component costs. Suppliers may offer bundled pricing, making it difficult to assess the true cost of individual components like semiconductors or printed circuit boards (PCBs). Should costing helps manufacturers break down the cost of each component and benchmark it against market prices, enabling more informed negotiations with suppliers.

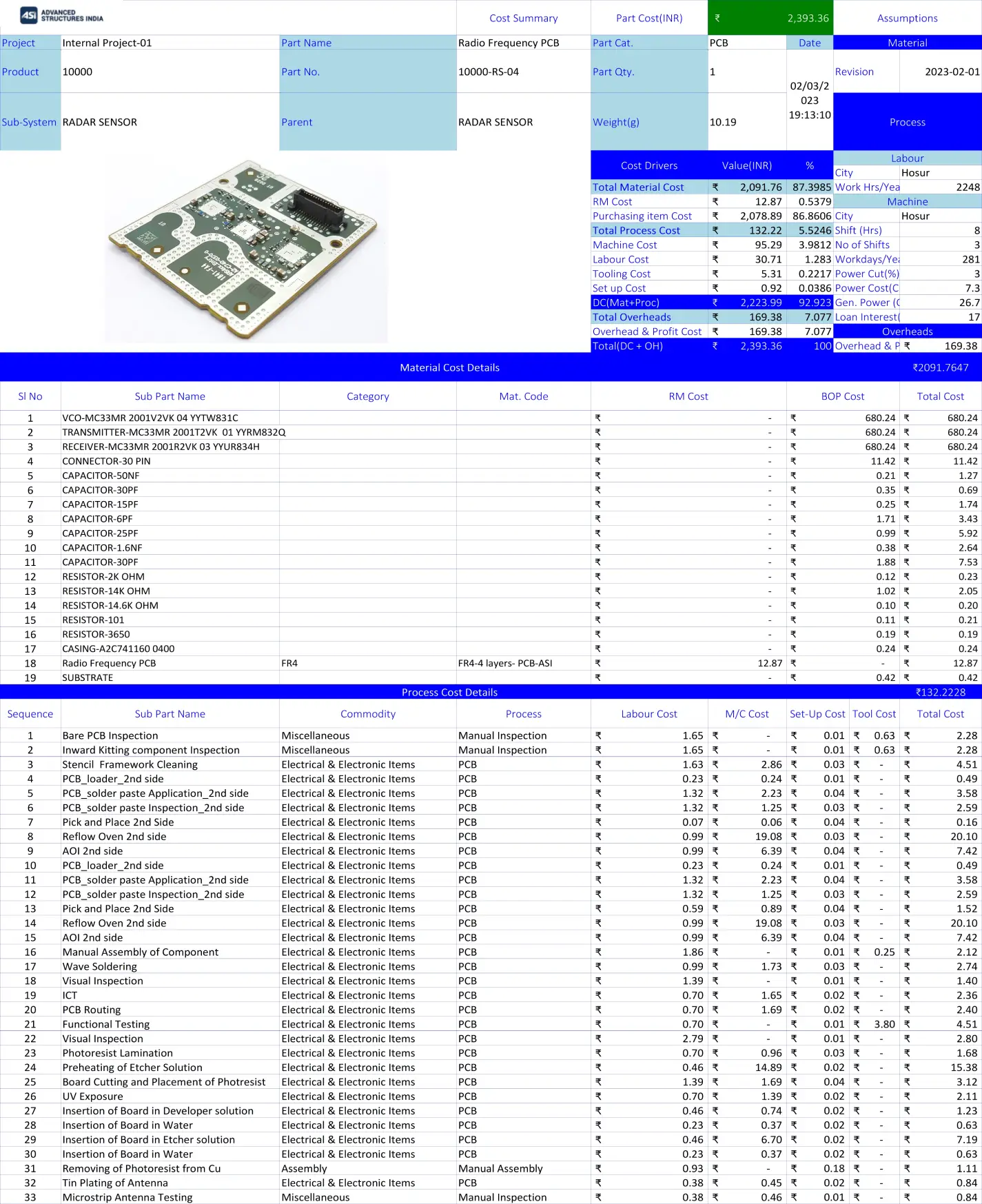

This point is evident from the following table which shows BOM of a single radar sensor for ADAS application.

High-Value Components

Unlike traditional automotive parts, electronics are often high-value components that have a disproportionate impact on the overall cost of the vehicle. For instance, the cost of an ADAS system may rival the cost of the vehicle’s engine. By using should costing, manufacturers can ensure they are getting the best possible price for these high-value components.

Rapid Technological Advancement

The rapid pace of technological advancement in automotive electronics means that material and production costs fluctuate frequently. Should costing helps manufacturers stay ahead of these fluctuations by regularly updating cost models with the latest material and labor rates. This is particularly important when dealing with fast-changing technologies like sensors, microchips, and other advanced components.

Conclusion

In today’s competitive automotive market, controlling costs is more critical than ever. Should costing provides manufacturers with the tools they need to manage costs effectively, from raw materials and labor to complex automotive electronics. However, the success of should costing depends on having the right tools in place.

While Apriori & its analogues are a useful tool for design engineers, xcPEP offers a more comprehensive solution for cost engineering teams looking to manage costs at scale. With its granular process mapping, real-time updates, and advanced analytics, xcPEP ensures that manufacturers have the data they need to make informed decisions and drive cost reductions across their organization.

For automotive companies looking to gain a competitive edge, should costing—combined with the right software—can be the key to success.