Deep Dive into 55HP Agricultural Tractor Part Should Costing & Benchmarking

Disclaimer

This study was conducted entirely in-house by ASI Engineering to demonstrate the capabilities of the xcPEP® platform. The product was independently procured by ASI. No proprietary or confidential information from any other party has been used. Results are not updated after publishing.

Software platforms used for this study

This study is powered by ASI’s proprietary should-costing ecosystem - xcPEP and xcPROC - engineered to deliver real-world accurate, traceable should-costing across mechanical, electrical, and electronics components..

xcPEP delivers real-world accurate, transparent & defensible should cost analysis of mechanical, electrical & electronics components from drawings or physical parts.

Explore xcPEP →

xcPROC is the centralized database engine powering xcPEP. Built entirely by ASI’s data research team, each database is meticulously curated to be region-specific and time-specific.

Explore xcPROC →Introduction: Navigating High Tractor Costs with Should Costing and Benchmarking

The agricultural machinery sector in India continues to evolve rapidly, with rising demand for mid-range tractors that balance power, efficiency, and affordability. For both farmers aiming to reduce tractor ownership costs and manufacturers striving for competitive pricing, understanding the true cost of components is paramount.

This in-depth analysis presents a complete teardown and should-costing analysis of a popular 55 HP diesel-powered agricultural tractor. We delve into this widely popular segment to estimate the Bill of Materials (BOM) and uncover the precise cost distribution across key tractor subsystems. Our goal is to provide actionable insights for tractor cost optimization, value engineering, and strategic sourcing through meticulous tractor parts benchmarking.

55HP Tractor Specifications: A Foundation for Cost Analysis

Understanding the specifications provides the context for our cost estimations. This 55 HP tractor, a common choice for small-to-medium landholding farmers, forms the basis of our tractor part should cost assessment.

Parameter

Details

Tractor Subsystem Architecture: Deconstructing for Cost Insights

The tractor was meticulously disassembled into 10 functional subsystems. This process allowed us to better understand the internal layout, assembly complexity, and component-level interdependence, all critical factors for accurate should costing and benchmarking farm equipment. These include: Engine, After-Treatment System (ATS), Transmission & Driveline, Front Axle, Hydraulic System, Cab Operator Station, Electrical & Electronic Control Unit (ECU), Tyres & Wheels, and Tools & Accessories.

Engine Subsystem: Core of Tractor Performance and Cost

At the heart of the tractor lies a 3-cylinder diesel engine, optimized for rural field conditions. The cast-iron engine block, designed for high torque and long operational hours, contributes significantly to tractor manufacturing cost. The teardown revealed a direct-injection system. Supporting components include an air intake manifold, turbocharger, and a wet cylinder liner setup, all analyzed for their individual tractor engine parts cost.

Transmission & Driveline: Key to Power Transfer and High Costs

The transmission system, featuring a full constant mesh or synchromesh setup with 12 forward and 4 reverse gears, is a major tractor cost driver. The teardown revealed forged steel gear clusters, oil-lubricated shafts, and a robust differential. The rear axle connects to the PTO output and is built for high torque transfer, making its cost analysis vital for tractor cost reduction.

Hydraulic System: Essential for Implements and Cost Efficiency

One of the most vital systems in a tractor, the hydraulic system is responsible for operating implements like rotavators, ploughs, and cultivators. The teardown exposed a gear-type hydraulic pump connected to the PTO, a draft control valve, and lift arms with a mechanical sensing mechanism. Understanding the hydraulic system cost is key to cost-effective tractor parts sourcing.

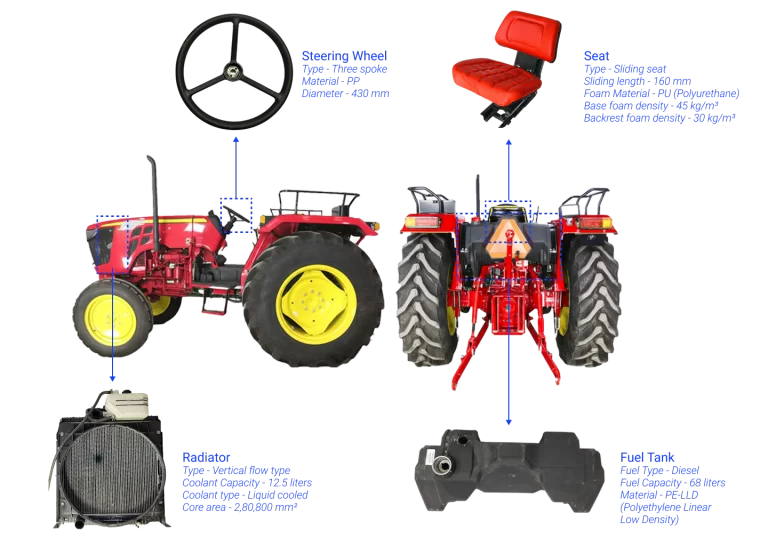

Cab Operator Station: Ergonomics vs. Cost Implications

Although tractors in this segment are not cabin-equipped like their higher-end counterparts, the operator station is ergonomically designed for long working hours. The seat is suspension-mounted with adjustable back support. The steering column includes a console with analog or semi-digital instrumentation for RPM, fuel level, and PTO engagement status. Analyzing the operator station cost helps in identifying areas for tractor comfort feature cost optimization.

Electrical & ECU: The Growing Role in Tractor Cost

The tractor is equipped with a 12V electrical system that powers the lights, instruments, and starter motor. The teardown revealed a basic wiring harness, a 65–80Ah battery, alternator, and fuses. For BS-V emission compliance, an ECU is used to manage fuel injection and diagnostic protocols. The electrical system cost is a growing segment in tractor part should costs.

After-Treatment System (ATS): Regulatory Compliance and Cost

The BS-V emission regulations necessitate an after-treatment system, which in this tractor includes a Diesel Oxidation Catalyst (DOC) and Diesel Particulate Filter (DPF). Temperature and NOx sensors are mounted both upstream and downstream of the system for real-time emission monitoring. While low in weight, the ATS cost is critical for regulatory compliance in tractor manufacturing.

Tyres & Wheels: Significant Contributor to BOM Cost

The front tyres are 6.5 x 20 and the rear tyres are 16.9 x 28—standard for 2WD tractors in this segment. These are supplied by local manufacturers such as CEAT, JK Tyre, and MRF. Tyres contribute approximately 12–15% to the total BOM cost and are fully localized. This highlights the importance of benchmarking tractor tire prices for overall tractor cost reduction.

Visual Breakdown of Key Comfort and Utility Components

Tractor Bill of Material (BOM) Breakdown: Granular View of Tractor Costs

We conducted a detailed teardown of a 55 HP tractor to gain a deep understanding of its subsystem architecture, internal assemblies, and part composition. This teardown study focused on identifying and analyzing various component attributes, enabling a granular view of the machine’s design, material usage, and mechanical integration.

Following the tractor teardown, we developed a Multi-level BOM (Bill of Materials) structure that maps the entire tractor, from major subsystems such as powertrain and chassis to finer elements like fasteners and electricals. This structured BOM offers valuable insights into the tractor's construction, manufacturing strategy, and cost distribution across different assemblies, crucial for benchmarking tractor parts effectively.

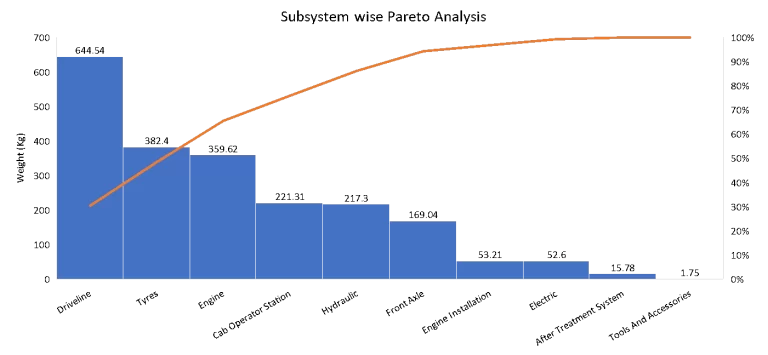

Subsystem-Wise Weight Contribution – Pareto Analysis of a 55 HP Tractor: Identifying Weight-Cost Relationships

To better understand which manufacturing categories contribute the most to the overall weight of the 55 HP tractor, a Pareto analysis was conducted. This analysis helps identify areas for lightweighting and material substitution which directly impact tractor manufacturing costs.

Key Observations

The top three subsystems — Driveline, Tyres, and Engine — contribute over 70% of the total tractor weight:

Driveline alone contributes nearly 35–40%, making it the single largest contributor.

Tyres and Engine follow closely, reflecting the dominance of propulsion and load-bearing components.

Secondary contributors include: Cab/Operator Station, Hydraulic System, Front Axle. Together, these push the cumulative weight contribution to around 90%, underscoring the importance of control, comfort, and support systems.

Remaining subsystems such as: Engine Installation, Electrical, After-Treatment System, Tools and Accessories account for less than 10% of the weight but remain vital for regulatory compliance, system integration, and overall functionality.

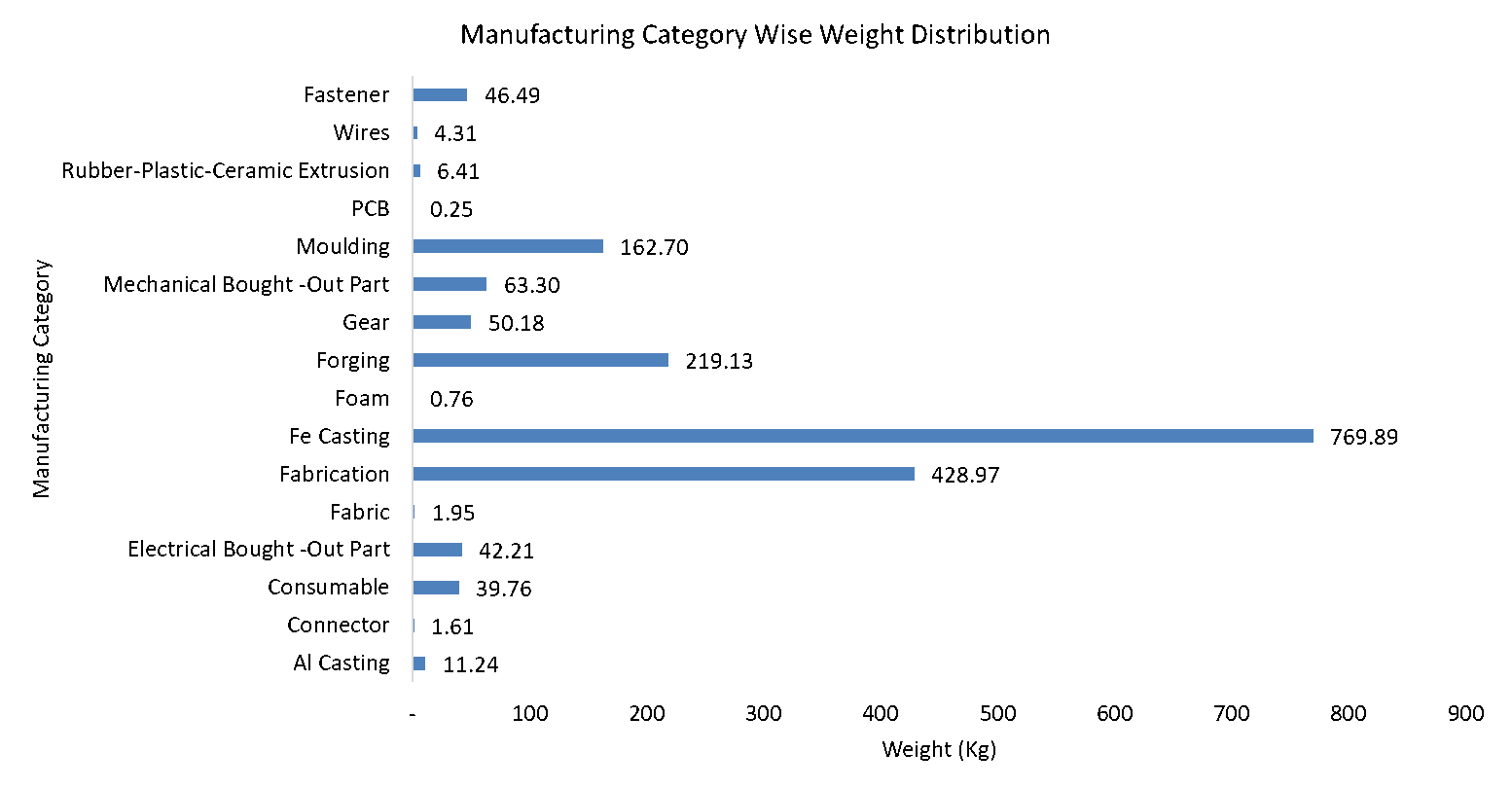

Manufacturing Category-Wise Weight Distribution Analysis of 55 HP Tractor: Opportunities for Cost Optimization

A granular view of the weight distribution across manufacturing categories provides deep insights into the material and process choices made during the development of a 55 HP tractor. This breakdown not only highlights the contribution of cast, forged, and fabricated components but also helps in identifying opportunities for lightweighting, material substitution, and significant tractor cost optimization.

Key Highlights from the Weight Distribution

Fe Casting (Ferrous Casting) is the heaviest contributor, making up 769.8 kg, clearly indicating its dominance in the structural and drivetrain components such as housings, axle cases, and engine blocks.

Fabrication parts weigh 428.9 kg, representing a significant share, with parts like fenders, wheel rims, etc.

Forging accounts for 219.1 kg, likely representing high-strength components like shafts, gears, and connecting rods.

Moulding parts weigh 162.7 kg, typically encompassing plastic or composite moulded parts used in interior trims and housings.

Mechanical Bought-Out Parts contribute 63.3 kg, reflecting prefabricated assemblies sourced from vendors such as bearings, pulleys, and mechanical linkages.

Gears alone weigh 50.1 kg, emphasizing their mass and importance in the drivetrain and transmission system.

Fasteners (46.4 kg), and Electrical Bought-Out Parts (42.2 kg) each represent a significant share, collectively supporting the assembly structure, joining elements, and electrical integration.

Consumables like fluids, filters, and gaskets contribute 39.7 kg, while Rubber-Plastic-Ceramic Extrusions add 6.4 kg, possibly for sealing and insulation purposes.

Lightweight categories include Aluminium Casting (11.2 kg), Connectors (1.6 kg), Wires (4.3 kg), Fabric (1.9 kg), and PCB (253 g), reflecting smaller yet essential elements in the tractor’s control and power circuits.

Foam, used for cushioning and insulation, contributes minimally at just 760g.

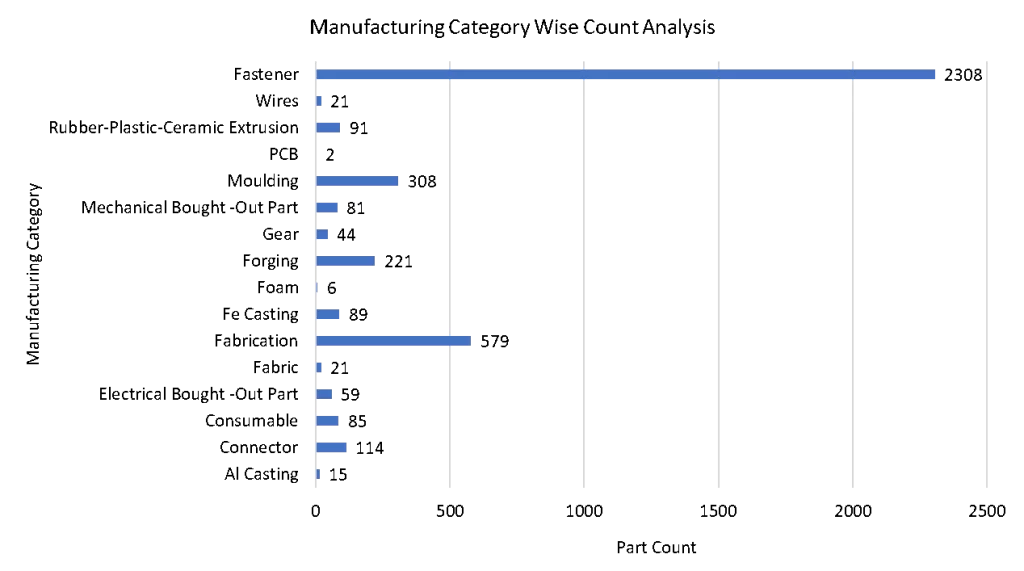

Manufacturing Category-Wise Count Analysis: Understanding Assembly Complexity and Sourcing

Analyzing part counts across manufacturing categories provides insight into the complexity of assembly, supply chain dependencies, and the design strategy of the 55 HP tractor. While heavier categories dominate the structural aspects, count-based analysis highlights areas of high integration and component diversity, offering clues for reducing tractor assembly costs.

Key Highlights from the Count Analysis

Fasteners dominate the component count with 2,308 parts, highlighting their fundamental role in assembly and modular construction across the tractor.

Fabrication parts are next with 579 components, primarily involving brackets, sheet-metal structures, and welded assemblies.

Moulding accounts for 308 parts, reflecting a significant number of plastic or polymer-based components used in covers, trims, and interior parts.

Forging contributes 221 components, representing high-strength elements such as gears, shafts, and knuckles.

Connector (114) and Rubber-Plastic-Ceramic Extrusion (91) categories support electrical and sealing systems respectively, ensuring reliability and comfort.

Fe Casting parts total 89, showing fewer but typically heavy and critical structural components.

Mechanical Bought-Out Parts (81) and Consumables (85) reflect vendor-supplied items like bearings, filters, and linkages.

Electrical Bought-Out Parts count at 59, indicating a moderate presence of electrical sub-assemblies and control units.

Gear components are 44, aligning with the tractor’s transmission complexity.

Wires and Fabric (both 21) are present in lower counts but are critical for harnessing and cabin interiors.

Aluminium Casting includes 15 components, used likely in lighter non-load bearing parts.

Foam and PCBs have minimal counts (6 and 2 respectively), indicating selective use in operator comfort and electronic control systems.

This count-based breakdown reveals the intricate balance between structural robustness and integration flexibility, offering insights into design optimization and assembly streamlining opportunities to reduce tractor costs.

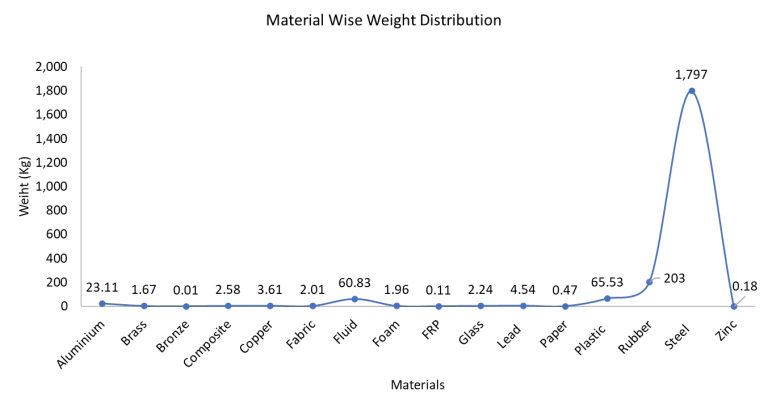

Material-Wise Weight Distribution Analysis: Strategic Material Selection for Cost Efficiency

Understanding the material composition of the tractor offers valuable insights into design priorities such as durability, manufacturability, cost-efficiency, and weight optimization. The breakdown below highlights how various materials contribute to the overall mass of the tractor, providing targets for material cost reduction in tractor manufacturing.

Key observations from the Material Wise Weight Distribution

Steel is by far the dominant material, contributing 1,797 kg, reflecting its widespread use in high-strength structural and load-bearing components such as chassis, housings, axles, and drivetrain assemblies.

Rubber is the second-largest contributor at 203 kg, largely from tyres, seals, hoses, and vibration isolation elements.

Plastic materials weigh 65.53 kg, used in interior trims, housings, covers, and various moulded components.

Fluid (coolants, oils, hydraulic fluids, etc.) contributes 60.83 kg, underlining the role of hydraulics and thermal management systems.

Aluminium accounts for 23.11 kg, primarily used in non-structural parts or for lightweight applications where corrosion resistance is important.

Copper (3.61 kg) and Glass (2.24 kg) are present due to their use in wiring and operator cabin visibility respectively.

Composites (2.58 kg), Fabric (2.01 kg), and Foam (1.96 kg) are typically used for comfort, insulation, and lightweight applications in the cabin or trim.

Lead (4.54 kg) likely reflects battery components or counterweights.

Brass (1.67 kg) and Bronze (0.01 kg) are minor contributors, used in bushings or wear-resistant parts.

FRP (0.11 kg), Paper (0.47 kg), and Zinc (0.18 kg) contribute negligibly, indicating limited application in select non-structural or electrical contexts.

This analysis highlights that over 85% of the tractor’s weight comes from just three materials—Steel, Rubber, and Plastic—demonstrating a typical composition balance between strength, flexibility, and manufacturability, and pinpointing key areas for material cost reduction strategies.

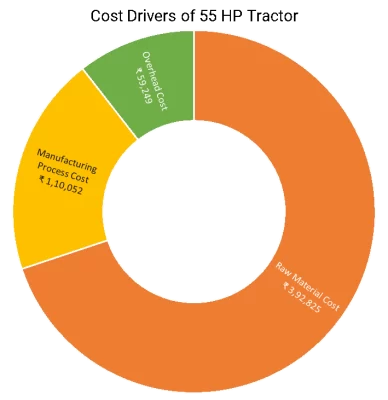

Tractor Should-Cost Analysis: Estimating True Manufacturing Expenses

We conducted a comprehensive teardown of the 55 HP tractor, involving a detailed assessment of each subsystem and component. The goal was to map all part attributes and materials to evaluate manufacturing feasibility and derive an accurate cost estimation for the complete tractor assembly. This tractor should costing methodology provides a benchmark for optimizing tractor production costs.

Should Cost Drivers of a 55 HP Tractor

A Multi-level Bill of Materials (BOM), along with in-depth subsystem analysis and Should-Costing, was performed on the 55 HP tractor. Based on the teardown findings and part-level assessments, the estimated manufacturing cost of the tractor is INR 5,62,126. The following factors were considered in the study:

- The tractor was manufactured in India.

- The estimated production volume for the study was set at 10,000 units annually.

- The latest material rates and labor cost benchmarks were taken for Q1 FY25-26.

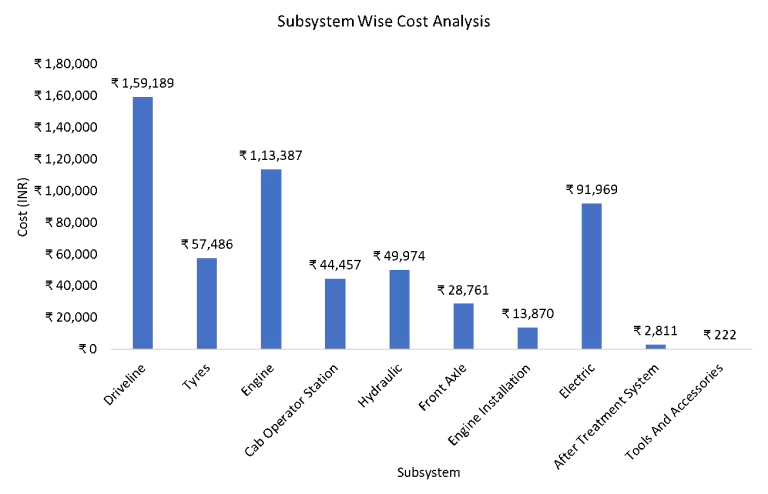

Subsystem-Wise Cost Analysis of a 55 HP Tractor: Prioritizing Cost Reduction Efforts

A detailed subsystem-level cost analysis was performed on a 55 HP tractor to understand the cost contribution of each major assembly. The analysis was supported by teardown data and part-wise cost estimations, with the results visualized in the bar chart. This provides clear targets for reducing tractor component costs.

Key Observations

Driveline is the most expensive subsystem, costing ₹1,59,189, contributing the largest share to total manufacturing cost. This makes it a prime area for value engineering in tractor design.

Engine follows closely with a cost of ₹1,13,387, making it the second-highest contributor. Strategies to lower tractor engine costs are crucial.

Electrical system also contributes significantly at ₹91,969, reflecting the growing role of electronic components in modern tractors and the need for electrical system cost optimization.

Other moderate contributors include Tyres (₹57,486), Hydraulic system (₹49,974), and Cab Operator Station (₹44,457).

Front Axle (₹28,761) and Engine Installation (₹13,870) show relatively lower costs.

After-Treatment System (₹2,811) and Tools & Accessories (₹222) are the least cost-intensive components.

This analysis helps prioritize cost optimization efforts towards high-impact areas such as the driveline, engine, and electrical systems for effective tractor cost reduction strategies.

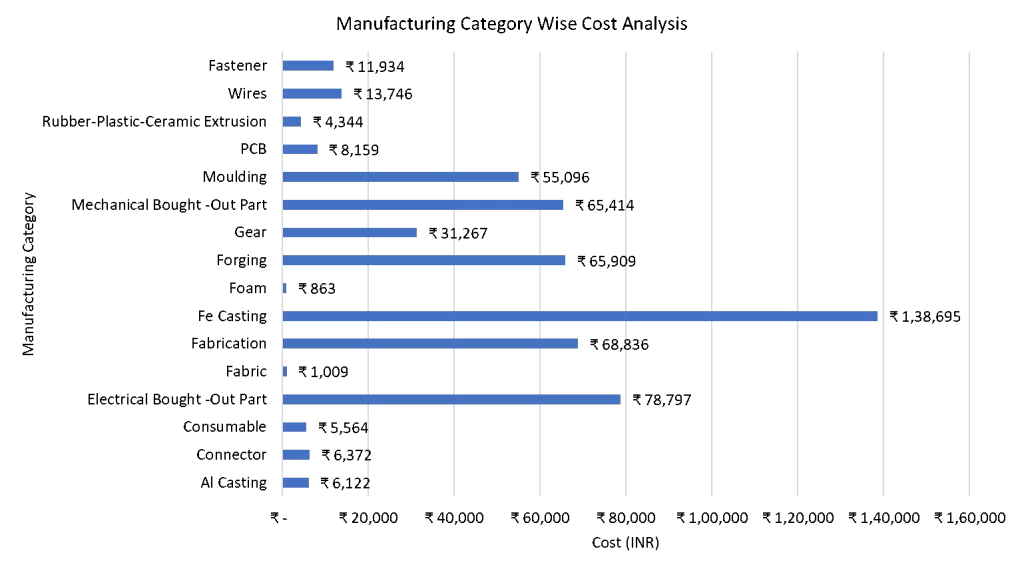

Manufacturing Category-Wise Cost Analysis of a 55 HP Tractor: Targeting High-Impact Processes

A detailed cost assessment was carried out by mapping all components of the 55 HP tractor to their respective manufacturing categories. This analysis helps in identifying which manufacturing processes or part types contribute most to the total cost and are therefore key targets for cost optimization and benchmarking manufacturing processes.

Key Insights

Fe Casting dominates the cost distribution with ₹1,38,695, accounting for a significant share due to its extensive use in structural and load-bearing components like housings and axles.

Electrical Bought-Out Parts are the next major contributor at ₹78,797, highlighting the growing role of electrification in tractors.

Fabrication activities such as welding, cutting, and structural assembly make up ₹68,836, representing a sizeable portion.

Forging and Mechanical Bought-Out Parts contribute ₹65,909 and ₹65,414, respectively, mostly from drivetrain and transmission assemblies.

Moulding processes account for ₹55,096, commonly used in plastic covers, housings, and interior parts.

Gear components, critical to power transmission, add ₹31,267 to the total cost.

This breakdown shows that over 60% of the cost is concentrated in just Fe Casting, Electrical Parts, Fabrication, and Forging, making these areas prime candidates for value engineering, vendor optimization, and design rationalization efforts to reduce tractor costs.

Key Insights Gained from the Tractor Teardown: Actionable Strategies for Cost Savings

The comprehensive teardown and should-cost analysis provided critical insights for reducing tractor costs and improving competitiveness:

Driveline and Engine Dominate Costs: Together, these subsystems account for the highest share of weight and manufacturing cost, making them prime targets for cost optimization through tractor component redesign or alternative material sourcing.

Fe Castings Lead Material Usage: Heavy reliance on steel castings indicates a focus on structural strength and durability, but also presents opportunities for material cost reduction if lighter, equally robust alternatives are viable.

Electrical Systems Are Gaining Significance: Electrical components and ECUs are contributing more to cost due to regulatory and feature-driven requirements. Benchmarking tractor electrical system costs is vital.

Hydraulics Define Implement Compatibility: The design and efficiency of the hydraulic system directly influence performance with various farm implements, impacting perceived value and tractor operational costs.

High Fastener Count Shows Modular Design: Over 2,000 fasteners reflect a highly serviceable, modular assembly approach, which can influence assembly time and labor costs.

Cabin Ergonomics Matter: Even without an enclosed cab, comfort features like suspension seats and intuitive controls are well-integrated, suggesting an investment in operator comfort which should be cost-optimized without compromising usability.

Emission Compliance Adds Complexity: BS-V norms necessitate after-treatment systems that, while low in weight, are critical to compliance and add a non-negotiable regulatory cost to tractors.

These insights collectively support targeted cost reduction strategies, improved manufacturability, and informed product feature planning, all crucial for anyone looking to lower their tractor costs or implement effective benchmarking strategies.

Conclusion: Your Path to Lower Tractor Costs Through Should Costing and Benchmarking

The meticulous teardown and should-cost analysis of the 55 HP tractor highlights key cost and weight drivers—primarily the driveline, engine, and electrical systems. Steel remains the dominant material, supported by significant use of forgings, castings, and fabricated parts.

This study offers actionable insights for tractor cost optimization through design refinement, strategic material choices, and efficient sourcing strategies. By systematically benchmarking tractor parts and applying robust should costing methodologies, both agricultural equipment manufacturers and farmers can identify critical areas for significant cost reduction, streamline supply chains, and make informed design and purchasing decisions. As tractors evolve with modern features and regulations, such data-driven analysis is crucial for staying competitive and ensuring profitability in the agricultural machinery segment.