Driving Portfolio Value

for Private Equity

ASI Engineering's precision approach to manufacturing cost reduction.

|

Unlocking EBITDA

Engineering-Led Cost Transformation for Portfolio Companies

|

||

| Challenge | ASI Solution | Value |

|---|---|---|

Key Challenges

|

Our Framework

|

Business Impact

|

| Core Technology Platforms | ||

|

xcPROC Procurement Intelligence

|

xcPEP Costing Engine Precise Should Costing

|

xcPEP Idea Module Automated Design & Commercial Idea Generation

|

| Build - Operate - Transfer Engagement Model | ||

|

Phase 1: Build Detailed Should-Costing Foundation

|

Phase 2: Operate Idea Generation & Implementation

|

Phase 3: Transfer Cost Engineering Function Handover

|

|

|

|

| Deliverables & Outcomes | ||

Immediate

|

Medium-Term

|

Long-Term

|

The Private Equity Imperative: Unlocking Value in Manufacturing Assets

The Challenge: Navigating Complexity and Cost Pressures

Private Equity firms investing in manufacturing assets frequently encounter challenges that obscure true cost drivers and impede value maximization. These include the complexity of diverse manufacturing processes, the volatility of global supply chains, fluctuating raw material prices, and dynamic labor costs across regions.

"Traditional analytical methods often prove inadequate in penetrating this opacity, leaving PE firms with a limited view of the granular opportunities for cost reduction and performance enhancement." "The inherent complexity of manufacturing, exacerbated by global dynamics, creates a 'black box' effect for Private Equity firms." This opacity hinders accurate valuation, risk assessment, and the identification of true value creation levers. Without a clear and granular understanding of the cost structure, it becomes challenging to pinpoint specific inefficiencies or to accurately assess the true potential for operational improvement within an acquired asset.

This lack of clarity can also lead to misjudgments in valuation during acquisition, increasing investment risk and limiting the ability to maximize returns post-acquisition, as the levers for value creation remain hidden or poorly understood.

The Opportunity: Strategic Cost Reduction and Performance Enhancement

"For Private Equity, strategic cost reduction and performance improvement are not merely about cutting expenses; they are fundamental levers for enhancing EBITDA, improving operating margins, and ultimately maximizing enterprise value upon exit." The significant opportunity lies in identifying and executing precise, data-driven interventions that yield sustainable financial returns, transforming manufacturing assets into highly efficient, profitable entities.

The pursuit of this opportunity is often constrained by the quality and granularity of available data. A lack of precise cost intelligence means that even well-intentioned cost-cutting initiatives can be broad-brush, potentially impacting product quality, innovation, or long-term value, rather than surgically targeting inefficiencies. "This can lead to short-term gains at the expense of long-term sustainability or product quality, ultimately devaluing the asset in the eyes of future buyers." It also creates a cycle of reactive cost-cutting rather than proactive optimization, underscoring the need for a more sophisticated approach to identifying and realizing value.

Advanced Structures India: A New Paradigm for Value Creation

Beyond Traditional Consulting: Our Technology-Driven Differentiator

Traditional management consulting firms and generic benchmarking companies often provide high-level strategic advice or static, aggregated data. While these services hold value, their methodologies frequently lack the granular, real-time, and engineering-led precision essential for unlocking deep-seated value in complex manufacturing operations.

"Advanced Structures India (ASI) fundamentally shifts this paradigm by prioritizing technology as the core enabler of cost engineering." "ASI's primary focus is on building and deploying proprietary cost engineering technology, xcPEP and xcPROC, rather than solely selling project engagements or database subscriptions." This approach aims to onboard Private Equity portfolio companies onto their powerful platforms, empowering them with internal capabilities for continuous cost optimization.

"Unlike generic platforms that rely on broad industry averages, xcPROC provides granular, part-level data tied to real manufacturing contexts, including tooling, cycle times, material yields, and live market rates, ensuring a transparent and defensible cost model that mirrors shop-floor reality." "Furthermore, ASI regularly develops fully customized datasets tailored to a client’s specific parts, processes, and geographies, which are maintained exclusively for that organization."

"This shift from 'consulting as a service' to 'technology as an enabler' represents a fundamental re-risking of value creation for Private Equity firms." "By internalizing the capabilities through ASI's platforms, portfolio companies gain continuous, scalable, and auditable cost intelligence, reducing reliance on external, project-based interventions and fostering self-sufficiency." "This model is highly attractive to Private Equity as it implies long-term, embedded value rather than episodic, external dependency, leading to more predictable and higher returns."

| Feature | ASI Engineering | Management Consultants |

|---|---|---|

| Core Offering | Technology platforms (xcPEP & xcPROC) and engineering services | Project-based strategic advice and high-level analysis |

| Methodology | Engineering-led, data-driven should costing and design-to-value | Financial analysis, industry benchmarks, and top-down strategy |

| Data Granularity | Granular, part-level data grounded in real manufacturing logic (e.g., material grades, machine cycle times, tooling costs) | High-level, aggregated industry data and benchmarks |

| Cost Model | Transparent and defensible; based on a single source of truth for all inputs and calculations | Often opaque; relies on proprietary models and aggregated data |

| Value Creation | Focuses on building internal, sustainable capabilities within the portfolio company (Build-Operate-Transfer model) | Delivers project-based findings and recommendations, often leading to ongoing dependency |

| Scalability | Highly scalable, enabling continuous cost optimization across multiple products and teams through a single platform | Typically project-specific, requiring new engagements for each new initiative |

| Auditability | Full audit trail of every cost input, idea, and version of the cost model; downloadable reports for validation | Findings are often high-level and difficult to audit at a granular, part-level |

| Goal | To empower the client with a self-sufficient, data-driven cost engineering function | To sell project engagements and provide strategic advisory services |

| Outcome | Long-term, compounding cost savings and enhanced enterprise value through institutionalized capabilities | Short-term gains from project-specific recommendations and strategy |

Engineering-Led Execution: Precision and Actionable Insights

ASI's approach is deeply rooted in rigorous engineering principles, ensuring that cost information is not abstract financial figures but is grounded in the tangible realities of manufacturing processes, material science, and design intricacies. This engineering-led execution translates directly into unparalleled precision and highly actionable information that directly informs design-to-value and performance improvement initiatives for Private Equity portfolio companies.

ASI Engineering, the in-house services team, supports clients by building comprehensive, process-wise cost models within xcPEP, utilizing actual manufacturing logic, routing, machine time, tool wear, and regional cost inputs. For example, their automotive should costing covers detailed models for plastic molding, metal forming, fabrication, electrical components, and machining. xcPEP is capable of mapping over 50 parameters for each part, including weight, geometry, material grade, manufacturing category, and specific electrical or mechanical attributes, enabling direct generation of precise cost models. For unique scenarios, users can even build custom cost models from scratch, defining process steps and formulas, with input data fetched from xcPROC. The ASI Data Research Team independently collects, validates, and maintains every dataset on xcPROC, ensuring it reflects real-world manufacturing practices.

Crucially, ASI engineers evaluate the ideas generated by xcPEP, add their expertise, and assess feasibility, leading to high implementation rates and tangible savings. For instance, in a BLDC motor study, 43% of generated ideas were implemented, resulting in a 13.2% cost saving. For an EV charger and a motor controller, 41% of generated ideas were implemented, leading to a 9.3% cost saving for each.

"The combination of deep engineering expertise with a robust, data-driven platform creates a powerful feedback loop that continuously refines cost models and idea generation." "This is not merely about identifying costs; it is about understanding the underlying reasons for those costs and the practical methods for altering them, leading to truly transformative Design-to-Value (DTV) outcomes." This iterative process ensures that the cost models are not static but continuously evolve with real-world manufacturing practices, material changes, and project requirements.

The engineers provide the crucial intelligence to the engineering intelligence platform, bridging the gap between theoretical cost analysis and practical application. This leads to higher accuracy, greater confidence in the cost data, and more practical, implementable cost reduction strategies. This approach aims to translate theoretical savings into actual, realized value, which is paramount for Private Equity firms focused on tangible returns. "This direct link between engineering reality and precise cost data is the essence of Design-to-Value." "It allows for informed trade-offs and optimizations at the design stage, ensuring that cost reduction efforts do not compromise product performance or quality, but rather enhance overall value."

The Core Engines of Transformation: xcPEP and xcPROC

xcPEP: The Precision Costing Engine

"At the heart of ASI's value proposition is xcPEP, a next-generation should-cost analysis software engineered to address complex, real-world costing challenges." "It transcends simplistic cost estimations by providing a granular, transparent, and defensible view of part costs, rigorously grounded in actual manufacturing logic and real-world parameters."

Detailed Parameter Mapping and Configurable Models

xcPEP enables detailed mapping of Bill of Materials (BOM) and part-level attributes, capturing over 50 parameters per part, including weight, geometry, material grade, manufacturing category, and specific electrical or mechanical attributes, directly from teardown studies or engineering drawings. Its configurable cost models are structured with equations and logic relevant to specific manufacturing processes, allowing inputs like material usage, cycle time, tool life, labor, and overhead to be precisely adjusted. For unique or proprietary processes, users can even build fully custom cost models from scratch, with all necessary input data fetched directly from xcPROC.

Real-time Dashboards and Scenario Simulation

The platform includes built-in, real-time cost dashboards that display breakdowns by part, process, material, and supplier, eliminating the need for third-party business intelligence tools. A critical feature is its scenario simulation and comparison capability, which allows users to model the financial impact of modifying key inputs such as production volume, material grade, or supplier location, facilitating informed trade-offs. xcPEP also provides robust cost delta and driver analysis, highlighting changes and identifying key contributors to cost variation.

Collaboration, Integration, and Advanced Data Capture

It offers granular role-based access control and supports multi-team collaboration across engineering, sourcing, and finance. Furthermore, it includes import tools for BOMs and technical specifications, and allows for custom reporting with downloadable outputs in structured Excel formats for audits and discussions. For seamless integration with existing digital infrastructures, xcPEP provides APIs for bi-directional data exchange with external systems like PLM or ERP. To accelerate and standardize data capture, ASI has developed custom hardware systems that integrate directly with xcPEP, featuring AI-based PCB component identification, bounding box dimension capture, and automated projected area capture, supporting high-volume costing programs with speed, repeatability, and data reliability.

Predictive Capabilities for Strategic Decisions

"xcPEP's ability to model costs based on manufacturing logic rather than generic averages, combined with its powerful scenario simulation capabilities, transforms cost analysis from a static report into a dynamic, predictive decision-making tool." "This empowers Private Equity firms to not just understand current costs but to proactively model and predict the precise financial impact of strategic changes, such as shifting production locations, material substitution, or process optimization, before committing significant capital."

"This granular, logic-based costing combined with robust 'what-if' scenario planning provides powerful predictive capabilities." "Instead of merely knowing what the cost is, Private Equity firms can understand what the cost could be under various operational or design assumptions, and quantify the financial implications of each." "This capability is invaluable for both pre-acquisition due diligence, accurately assessing the true cost reduction potential of an acquisition target, and post-acquisition value creation, optimizing operations and negotiating with suppliers from a position of strength." "It allows for data-backed strategic decisions that directly impact financial outcomes and reduce investment risk." Private Equity firms are inherently forward-looking, seeking to optimize future performance and mitigate risk. xcPEP's predictive modeling capability directly addresses these needs, enabling more informed investment and operational decisions that drive higher returns.

xcPEP: The Integrated Idea Module for Continuous Improvement

"Identifying cost-saving opportunities is merely the initial step; ensuring their systematic capture, rigorous tracking, and successful implementation is where true, measurable value is realized." "xcPEP's integrated Idea Module provides a robust and systematic framework for managing cost reduction initiatives from their conception through to their successful execution."

Systematic Tracking and Accountability

This dedicated module precisely captures cost-saving ideas generated during should-costing, detailing proposal specifics, expected savings, the origin of the idea, and its current status. Teams can leverage this feature to meticulously track progress, assign clear ownership, and accurately quantify the financial impact of their cost-reduction efforts. The module ensures that valuable information derived from costing exercises is not lost or fragmented, but is instead centralized and directly tied to implementation. It plays a pivotal role in digitizing and managing a portfolio company's entire portfolio of cost reduction efforts across diverse teams and programs, centralizing ideas that might otherwise be scattered across disparate spreadsheets and email threads.

Simulation, Traceability, and Visibility

Users can simulate proposed changes modifying geometry, material, or process routing directly within the platform to evaluate the actual cost impact using integrated xcPROC data. Once approved, ideas are versioned into the main cost models, ensuring complete traceability from the initial proposal to final implementation. By bringing all cost reduction activities into xcPEP, portfolio companies gain critical visibility into their pipeline health, avoid duplication of effort, and ensure that cost-saving efforts can be consistently tracked, validated, and revisited at any time. ASI engineers play a role in evaluating these ideas, adding their expertise, and assessing their feasibility, leading to implementation rates of 43% for a BLDC motor and 41% for an EV charger and motor controller.

Institutionalizing Continuous Improvement

"The Idea Module closes the critical loop between analysis and action, transforming cost information from theoretical possibilities into trackable, accountable value creation projects." "This institutionalizes continuous improvement, moving beyond one-off consulting engagements to embed a sustainable culture of cost optimization and accountability within the portfolio company, leading to compounding returns."

"This systematic tracking, validation, and versioning process creates clear accountability for cost reduction initiatives and ensures that identified savings translate into actual, realized financial benefits." "It also builds an invaluable institutional memory of successful, and unsuccessful, initiatives, enabling learning and refinement." "For Private Equity, this means a significantly higher probability of realizing projected cost savings, improved operational efficiency, and a demonstrable, auditable track record of value creation within the portfolio company." "It shifts the paradigm from episodic projects to continuous, embedded improvement, enhancing the asset's intrinsic value." Private Equity firms are intensely focused on measurable results and maximizing exit value. The Idea Module directly supports this by ensuring that identified savings are systematically pursued, realized, and attributed, contributing directly to improved EBITDA and a higher valuation multiple.

xcPROC: The Dynamic Procurement Intelligence Platform

Effective procurement is a critical and often underutilized lever for both immediate cost reduction and long-term supply chain resilience. xcPROC provides a comprehensive data and insights platform that goes far beyond generic databases, offering granular, validated data essential for precise should costing, strategic supplier evaluation, and optimized part procurement across various industries.

Structured Databases and Continuous Updates

xcPROC is built around structured databases that form the foundation of all should-cost models in xcPEP, including raw materials, machines, operations, labor, standard parts, suppliers, currency, tools, and wage & salary. Crucially, these datasets are actively maintained and continuously expanded by ASI’s internal research team, with updates driven by real project requirements, and custom datasets developed for specific client needs. Every dataset is independently collected, validated, and maintained, ensuring it reflects real-world manufacturing practices. Unlike conventional platforms, xcPROC develops data specific to how each part is actually manufactured and sourced, avoiding broad industry averages.

Vendor Discovery and Part-Level Marketplace

The platform also serves as a robust vendor discovery and evaluation tool, providing structured supplier profiles that detail manufacturing capability, business information, and financial data. This comprehensive information supports data-backed supplier shortlisting, risk evaluation, and sourcing decisions. Furthermore, xcPROC integrates a part-level marketplace feature that supports the evaluation and procurement of mechanical and electrical components, allowing for detailed technical specifications, price–quantity data, and identification of alternate manufacturers based on capability analysis. This dynamic platform has been successfully deployed for vendor base development for new setups, alternate vendor identification, keeping core cost inputs updated for xcPEP subscribers, and developing and exporting parts from Indian vendors.

Strategic Advantage in Procurement

"xcPROC transforms procurement from a purely transactional activity into a strategic advantage." "By providing real-time, granular, and validated data on suppliers, materials, and processes, it enables Private Equity firms to proactively de-risk supply chains, optimize sourcing decisions with unprecedented precision, and unlock significant cost savings that are often hidden in opaque supplier negotiations."

"This deep, continuously updated data allows for highly informed negotiation, knowing a supplier's true cost structure, not just their quoted price, comprehensive risk assessment, evaluating supplier technical fitment, financial health, and production history, and rapid identification of alternative sourcing options." "It moves beyond simple price comparison to strategic supply chain management." "For Private Equity, this means more effective and defensible supplier negotiations, reduced supply chain risk, for example, mitigating single-source dependency or identifying geopolitical risks, and the ability to quickly pivot to cost-competitive alternatives, directly impacting Cost of Goods Sold (COGS) and, consequently, profitability." Private Equity firms are constantly seeking to optimize operational efficiency and reduce costs, especially COGS. xcPROC provides the intelligence and tools to do this systematically, defensibly, and continuously in the critical area of procurement, directly contributing to margin expansion and enterprise value.

Our Proven Engagement Framework: From Insight to Impact

ASI's engagement framework is meticulously designed to seamlessly integrate advanced cost engineering capabilities into a Private Equity portfolio company's operations, ensuring that granular information translates directly into tangible, measurable financial impact. The framework is structured around a robust "Build-Operate-Transfer" (BOT) model for establishing an in-house cost lab, which perfectly encapsulates the objectives of detailed should costing, idea generation, validation, and implementation. This model provides a structured, phased approach to value creation, from initial deep-dive analysis to the development of sustained, internal capability within the portfolio company

Phase 1: Deep Dive into Detailed Should Costing (Build Phase)

"This initial phase focuses on establishing the foundational cost intelligence for a portfolio company." "It involves a meticulous, engineering-led analysis to determine the precise 'should cost' of critical components and assemblies, providing a transparent, granular understanding of all underlying cost drivers." This phase is equivalent to the "Build" phase of ASI's Cost Lab Build-Operate-Transfer (BOT) model, laying the groundwork for a robust, in-house cost engineering function.

Key Activities in the Build Phase

Key activities include identifying target categories for costing, such as mechanical, electrical, or plastic components, defining key performance indicators (KPIs) for the new cost lab, and establishing its operational models to align with the Private Equity firm's specific objectives. ASI configures its cloud-based xcPEP software to align with the client's specific product families, ensuring its immediate relevance and accuracy. This phase also involves staffing the lab with engineers trained by ASI and creating comprehensive Standard Operating Procedures (SOPs) and workflows for the lab's operations, ensuring consistency and repeatability from the outset.

Detailed Should Costing Process

The detailed should costing process within this phase involves:

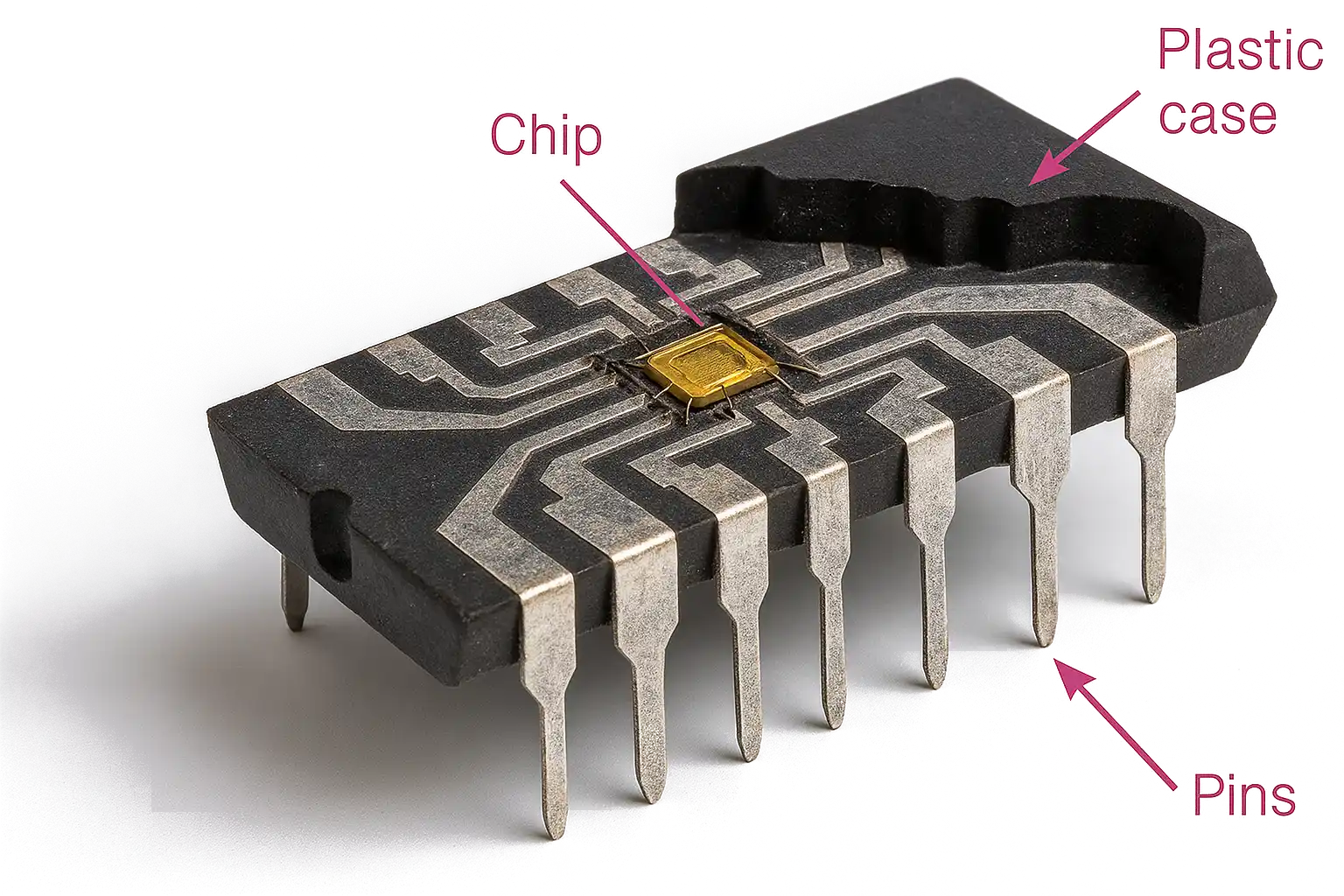

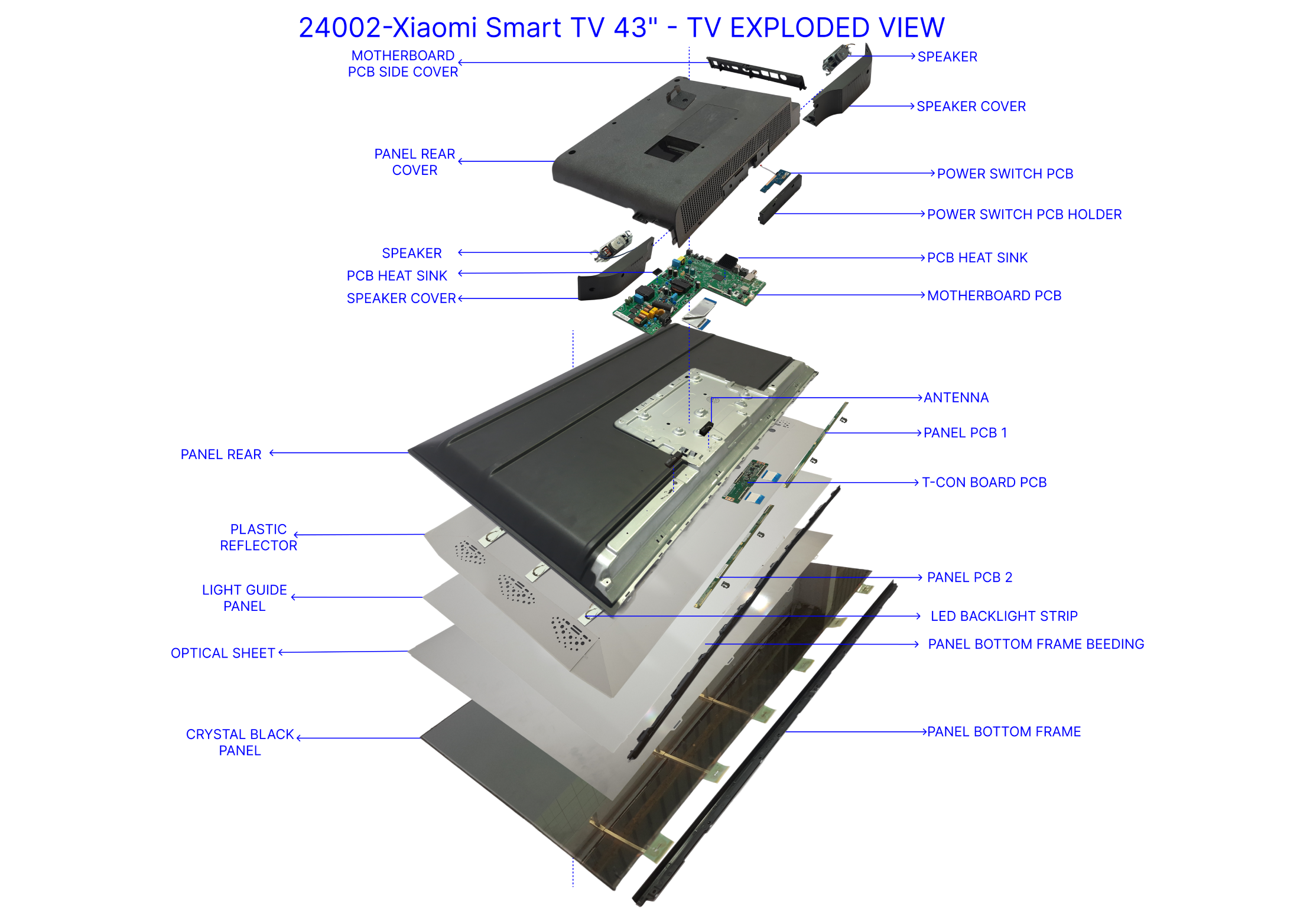

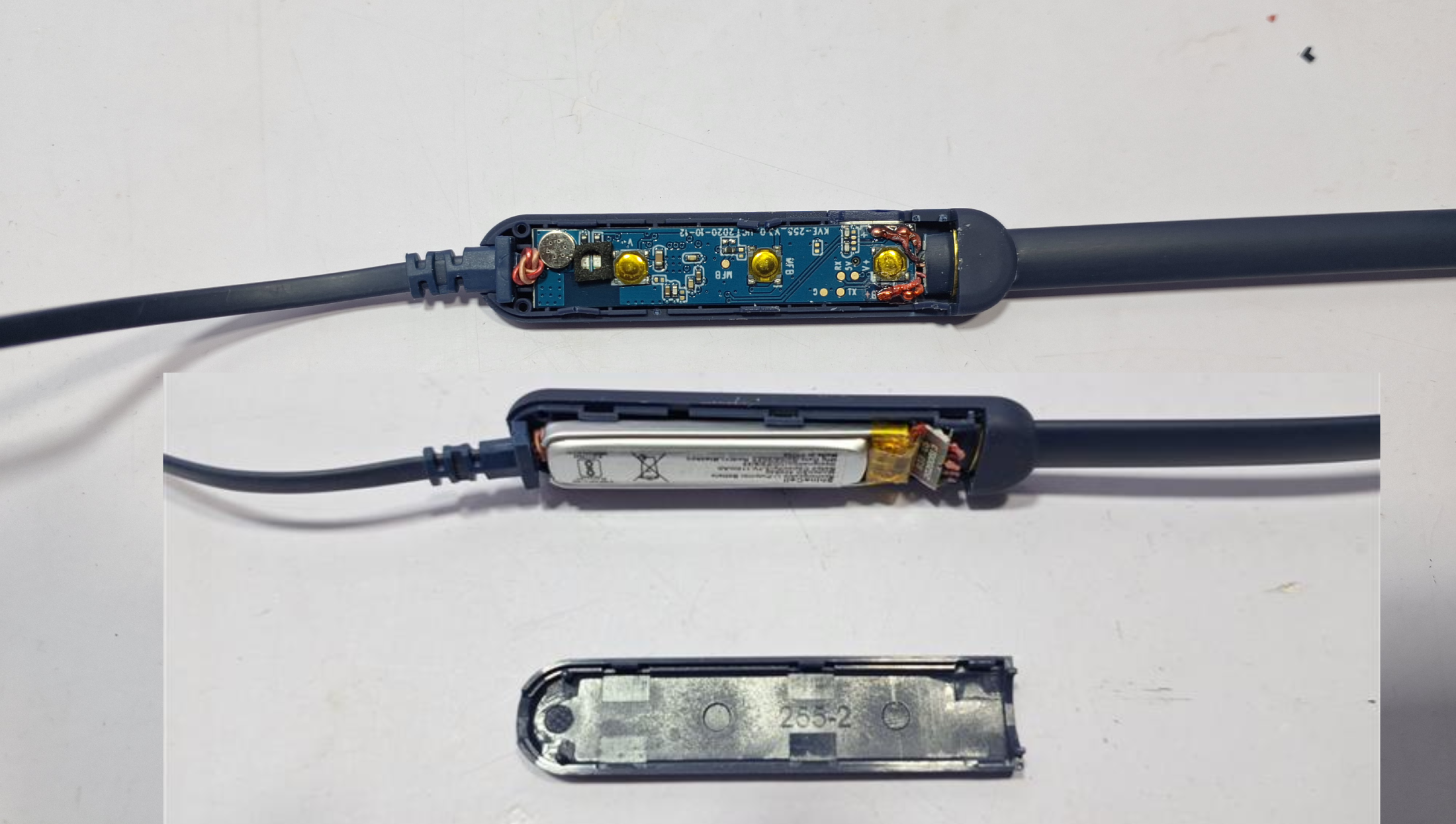

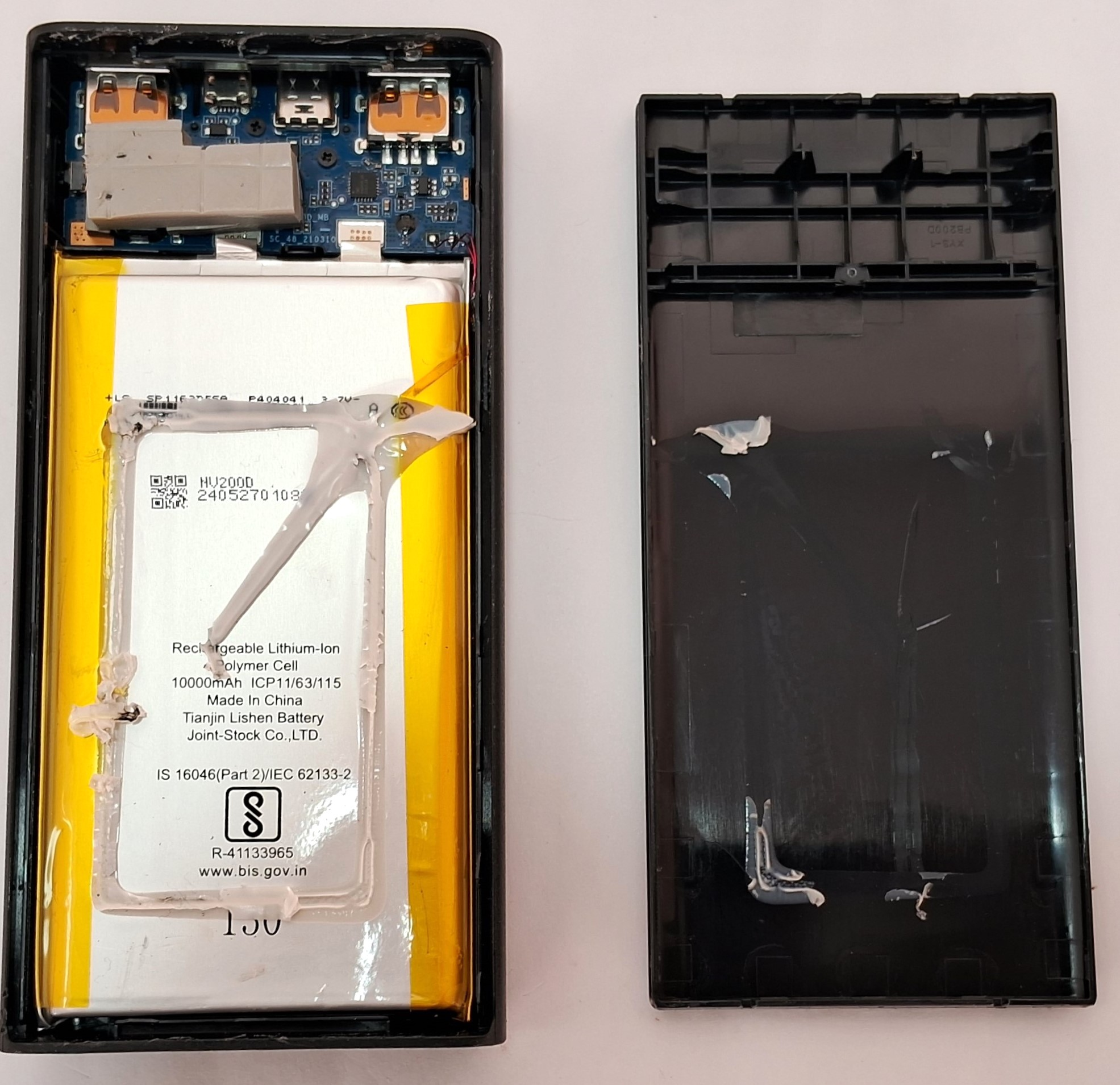

Own and Competitor Product Teardown Study: Systematic disassembly of products to understand their construction, identify key features, and map comprehensive product and sub-system packaging and exploded views. This includes capturing precise torque values before disassembly and utilizing specialized equipment like LCR meters, microscopes, and desoldering stations for detailed analysis of electronic components.

Bill of Materials (BOM) Generation: Meticulous mapping of product, sub-assembly, and individual part-level data within xcPEP. This involves capturing over 50 parameters per part, including weight, dimensions, material type, electrical specifications, manufacturing category, and surface finish. Multi-level BOM structures are developed to provide granular information into every component.

Architecture & Layout Study: In-depth analysis of the physical layout, component interconnections, and strategic material choices. This includes detailed examination of PCB layers, stack-up, material grades, heat sinks, and enclosure designs, providing a comprehensive understanding of the product's construction and potential areas for optimization.

Raw Material Analysis: Precise identification of material grades, thicknesses, and their direct contribution to both product weight and overall cost, enabling targeted material optimization strategies. For instance, a BLDC motor study revealed that using a lower gauge wire for stator winding could save winding material cost by 10%.

Process Cost Modeling: Building accurate, part-level cost models using actual manufacturing logic, including detailed routing, precise machine time calculations, tool wear considerations, and regional cost inputs. This encompasses models for a wide range of processes such as plastic molding, metal forming, fabrication, electrical component assembly, machining, welding, surface finishing, testing, and packaging.

Cost Breakdown & Driver Identification: Estimating the total manufacturing cost and meticulously breaking it down by raw material, process, and overheads. This granular analysis identifies the most significant cost drivers, such as specific PCBs in electronic devices or large castings and forgings in heavy machinery, pinpointing the highest leverage points for cost reduction. For example, in a blood pressure monitoring device, the Controller PCB alone contributed 50.2% of the total should-cost, making it the primary focus for optimization.

Establishing a Single Source of Truth

"This 'Build' phase, through its meticulous data capture, precise parameter mapping, and model configuration within xcPEP, establishes a single, auditable source of truth for manufacturing costs." "This eliminates reliance on fragmented data, subjective estimates, or opaque supplier quotes, providing Private Equity firms with unprecedented clarity and leverage in negotiations, strategic planning, and performance assessment."

"A single, transparent source of truth for costs significantly reduces information asymmetry, empowering the Private Equity firm and its portfolio company management team with a defensible understanding of true costs, providing a strong basis for challenging supplier pricing and optimizing internal processes." "For Private Equity, this translates to improved accuracy in due diligence, assessing true cost reduction potential of an acquisition target, more effective post-acquisition cost optimization, and a stronger basis for supplier negotiations, all of which directly impact the bottom line and enhance enterprise value." This reduces the risk of overlooking hidden costs or opportunities. Private Equity values transparency, data-backed decisions, and defensible financial models for investment decisions and value creation. This phase provides exactly that foundation, enabling a more strategic and less reactive approach to cost management.

Phase 2: Idea Generation, Validation, and Implementation (Operate & Transfer Phases)

"Building upon the deep information gained from detailed should costing, this phase transitions from analytical understanding to actionable impact." "It involves systematically generating cost reduction and design-to-value ideas, rigorously validating their potential impact, and ensuring their successful implementation." "Ultimately, this phase culminates in the transfer of capability for continuous improvement directly to the client's internal team." "This aligns with the 'Operate' and 'Transfer' phases of ASI's Cost Lab Build-Operate-Transfer (BOT) model, ensuring sustainable value creation."

Phases 2A, 2B, 2C, and 2D run in parallel once Phase 1 is completed.

Phase 2A: Design-Related Cost Reduction Idea Generation

Design-related cost reduction ideas are automatically generated in xcPEP using data from Phase 1. These ideas fall into categories such as design change, alternate material, alternate manufacturing process, packaging-based optimizations, and complexity reduction.

Phase 2B: Engineering Idea Evaluation and Implementation

Our team collaborates with your designers to evaluate and qualify these engineering and design ideas, ensuring their practical implementation.

Phase 2C: Commercial Idea Generation

Commercial ideas are generated by comparing the should cost with the actual cost. We also analyze if competitors are utilizing more cost-effective suppliers. Data from third-party sources, such as import-export records, and direct engagement with alternate vendors are used to generate and verify these ideas.

Phase 2D: Commercial Idea Implementation

Our team undertakes the groundwork to advance these commercial ideas, working closely with your procurement team to facilitate their implementation.

Sustainable Value Creation and Enhanced Exit Value

"The Build-Operate-Transfer (BOT) model, especially the 'Operate' and 'Transfer' phases, signifies a commitment to sustainable value creation rather than episodic project delivery." "This empowers Private Equity firms to not only realize immediate, quantifiable cost savings but also to build enduring capabilities within their portfolio companies, enhancing their long-term competitiveness, operational maturity, and ultimately, their attractiveness for future exits."

"This capability transfer creates a self-sustaining cost optimization function within the portfolio company." "It reduces the ongoing dependency on external consultants and allows for continuous, proactive cost management." "For Private Equity, this means that the value created is sticky and continues to accrue even after ASI's direct, intensive engagement reduces." "This enhances the operational maturity, efficiency, and intrinsic value of the asset, making it more robust and attractive for potential buyers, thereby commanding a higher exit multiple." Private Equity firms are concerned with maximizing long-term value creation and achieving optimal exit multiples. Building sustainable, in-house capabilities directly contributes to this by embedding a continuous improvement culture and reducing future operational costs.

Why ASI is the Strategic Partner for Private Equity

Unparalleled Transparency and Auditability

"For Private Equity firms, transparency in cost structures and the rigorous auditability of financial models are not merely desirable; they are paramount." "This ensures that investment decisions are based on reliable, verifiable data and that value creation initiatives can be rigorously tracked, defended, and ultimately monetized."

"ASI's platforms are meticulously built on a foundation of complete transparency, providing a clear and defensible cost picture." xcPROC delivers granular, part-level data directly tied to real manufacturing contexts, including tooling, cycle times, material yields, and live market rates, resulting in a transparent and auditable cost model that accurately reflects shop-floor reality. xcPEP allows teams to estimate part costs using precise manufacturing logic, regional rates, and technical parameters, offering full transparency into all calculations and inputs. "This inherent clarity empowers teams to confidently defend their decisions and align cross-functionally."

Furthermore, the xcPEP Idea Module ensures that all approved cost-saving ideas are versioned into the main cost models, creating a clear and immutable record that makes every change traceable from the initial proposal to final implementation. All outputs from xcPEP, including full cost breakdowns and comparison reports, are downloadable in structured Excel formats, ready for internal reviews, supplier discussions, or audits, enabling seamless communication and clear record-keeping of cost decisions.

Scalable and Sustainable Value Creation

"ASI's engagement model, particularly the Build-Operate-Transfer (BOT) framework, is designed to foster scalable and sustainable value creation within portfolio companies." "By transferring advanced cost engineering capabilities directly to the client's internal team, the model reduces the long-term reliance on external consultants and embeds a continuous improvement culture." "This approach ensures that cost optimization becomes an ongoing, internal process rather than a series of episodic projects." "Such institutionalized capabilities enhance a portfolio company's operational maturity, efficiency, and intrinsic value, making it more robust and attractive for future exits." The ability to continuously identify, validate, and implement cost reduction and design-to-value initiatives post-engagement translates directly into compounding returns and a stronger competitive position in the market.

Direct Impact on EBITDA and Enterprise Value

"The precision, transparency, and sustainability inherent in ASI's approach directly translate into tangible financial benefits for Private Equity firms." "By systematically identifying and realizing granular cost reductions, particularly in high-impact areas like raw materials, manufacturing processes, and complex components, ASI's methodology drives significant improvements in operating margins." "This directly enhances EBITDA, a critical metric for Private Equity valuations."

"Furthermore, the establishment of a robust, in-house cost engineering function, coupled with a track record of proven cost savings, signals operational excellence and a de-risked asset to potential buyers." "This translates into a higher enterprise value upon exit, maximizing returns for Private Equity investors." "ASI enables a shift from reactive cost-cutting to proactive, data-driven optimization, ensuring that every dollar saved is a dollar added to the bottom line and, ultimately, to the overall valuation of the manufacturing asset."

Product Studies

BLDC Hub Motor Teardown & Should Costing

Our engineers have benchmarked a BLDC motor used in an electric scooter to study its design, BOM and then conducted a zero-based costing exercise on it to get its direct material c

Catalytic Converter Benchmarking for Rare Earth Element Loading and Cost

Our engineers tore down a catalytic converter to study its design, materials and then conducted a zero based costing activity on all parts including rare earth element loading in t

LCV Steering Pump Teardown & Should Costing

This is a blog about benchmarking features, BOM and architecture of an automotive power steering pump. This also includes study of all direct costs of the hydraulic steering pump b

EV Charger Teardown & Cost Driver Comparison

This is a blog about benchmarking features, BOM and architecture of an electric vehicle charger. This also includes study of all direct costs of the EV charger by zero based costin

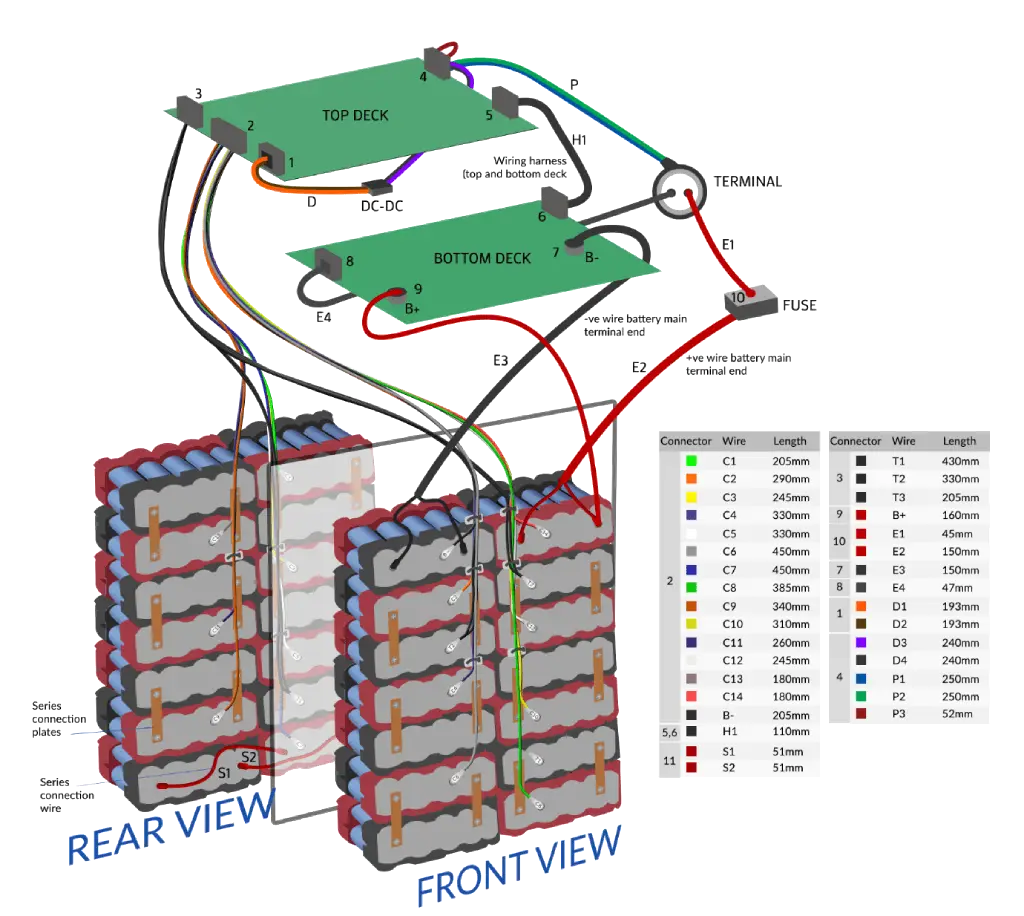

EV Battery Pack Teardown Study

This is a blog about benchmarking features, BOM and architecture of an electric vehicle battery pack. This also includes study of all direct costs of the li ion EV battery pack by

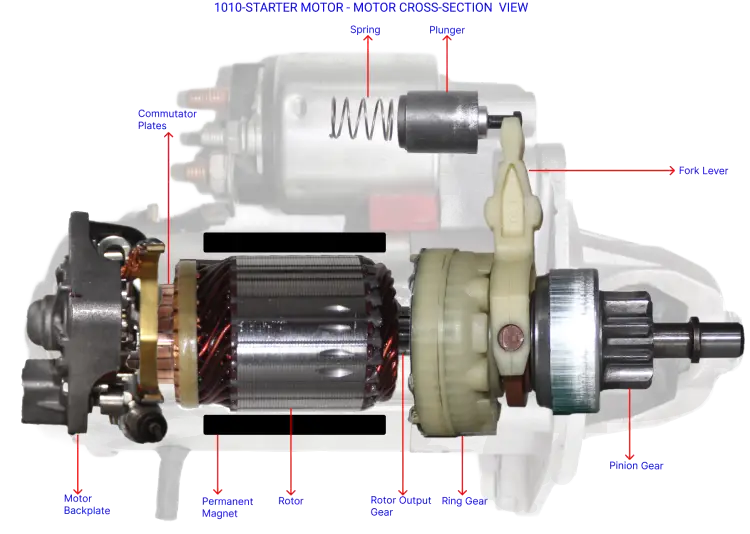

Starter Motor Teardown and Feature Study

This is a blog about benchmarking features, BOM, architecture and zero-based costing of an automotive starter motor.

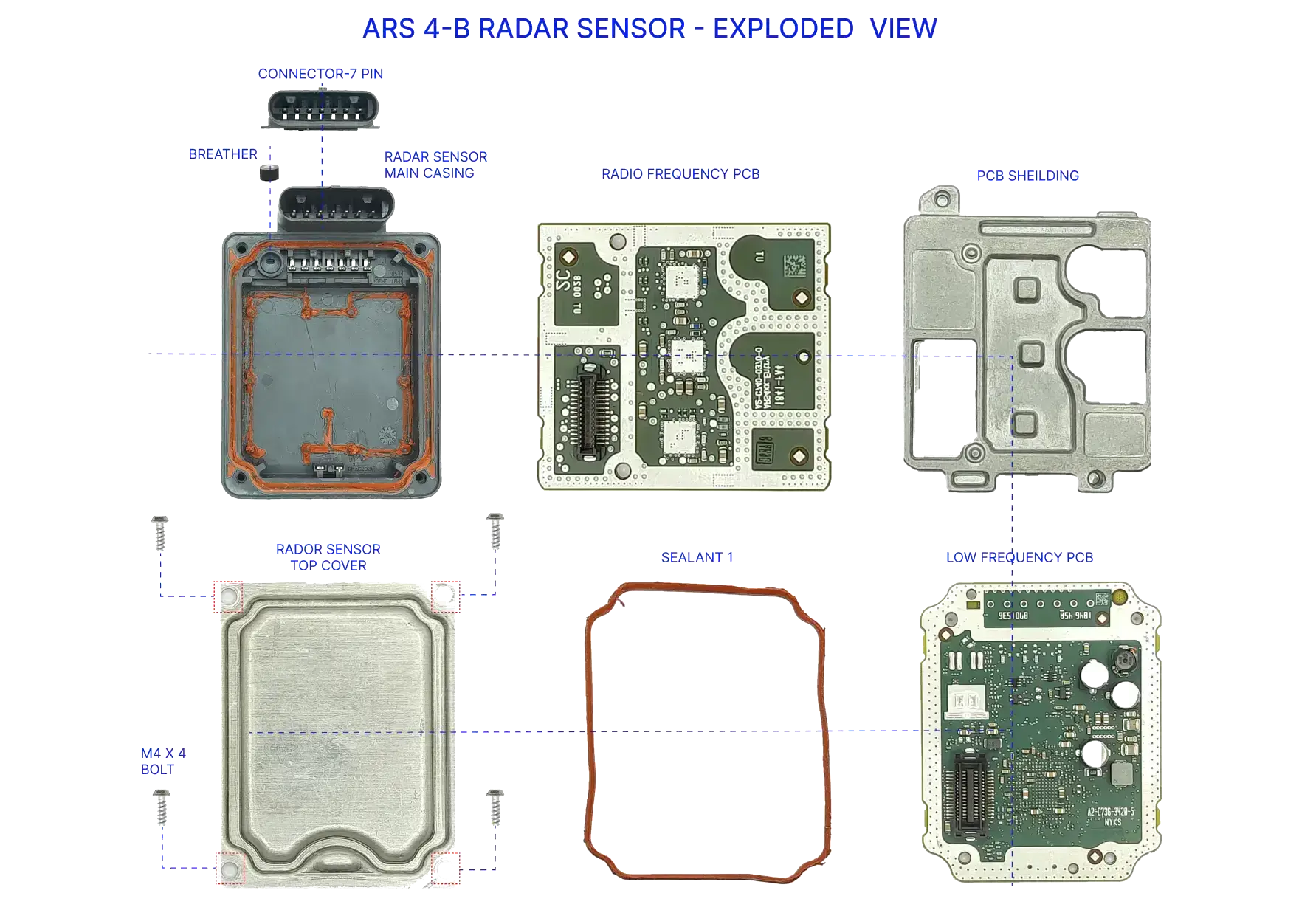

ADAS Radar Sensor Teardown & Should Costing

This is a blog post about how we've torn down and benchmarked an ADAS radar sensor to study its construction and then conducted a zero-based costing activity on it.

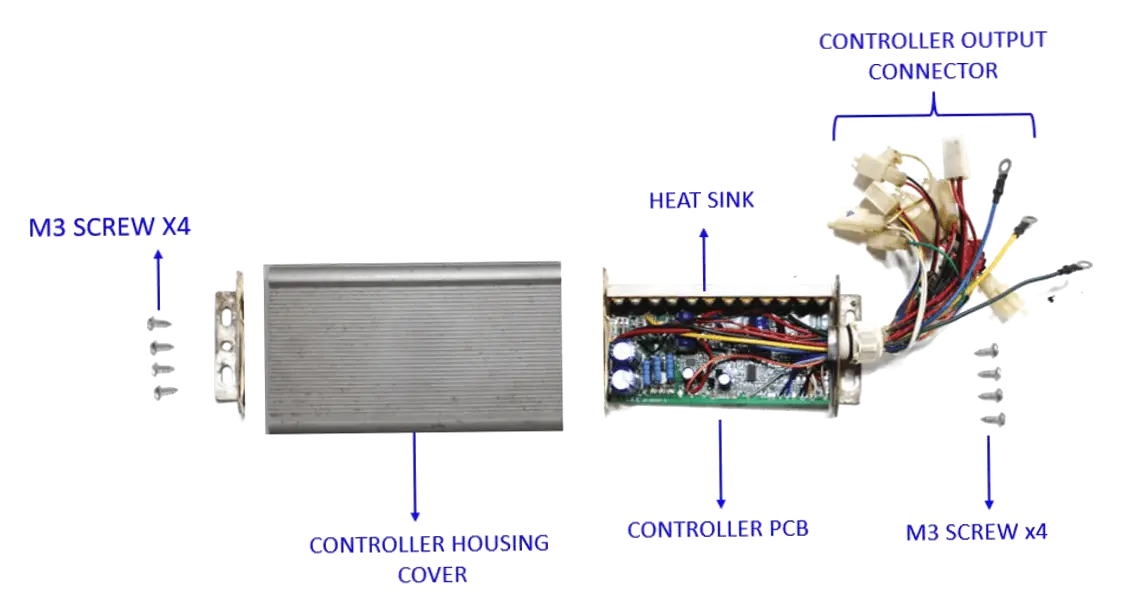

Motor Controller Teardown & Cost Driver Comparison

This is a blog about benchmarking features, BOM and architecture of an electric vehicle motor controller unit MCU. This also includes study of all direct costs of the MCU by zero b

How to do Should Costing of Semiconductor Packaging?

In this blog, we focus on the semiconductor packaging stage inside an IC. We should-costed the entire process - from die singulation and lead frame prep to bonding, molding, testin

Omron BP Monitoring Device HEM-7120 Teardown, BOM and Should Costing

Detailed teardown and Bill of Materials (BOM) analysis of the Omron HEM-7120 digital blood pressure monitor. Understand manufacturing costs and product design insights.

Xiaomi Smart LED TV 43” Teardown, BOM and Should Costing

Detailed teardown and BOM analysis of Smart TV 43. Explore LED TV component costs, and manufacturing insights.

Bluetooth Earphone Teardown, BOM and Costing

We have conducted a detailed teardown of a bluetooth neckband headphone, mapped its bill of material and calculated its should cost.

Mi PowerBank 3i Teardown and Costing

We have conducted a detailed teardown of a power bank, mapped its bill of material and calculated its should cost.

PCB Teardown Benchmarking & Cost Reduction Insights

This is a blog about benchmarking features, BOM and architecture of an automotive PCB. This also includes study of all direct costs of the PCB by zero based costing method.

DJI Inspire 1 Drone Teardown and Costing

We benchmarked a DJI Inspire 1 drone to study its design and direct cost. This study also included a detailed zero-based costing exercise of all the drone components.

Refrigerator Should-Costing & Teardown Analysis with xcPEP

The teardown of Haier’s 190L Direct Cool refrigerator reveals major cost drivers like the compressor, sheet metal, and foam moulding. While packaging adds bulk, sourcing efficien

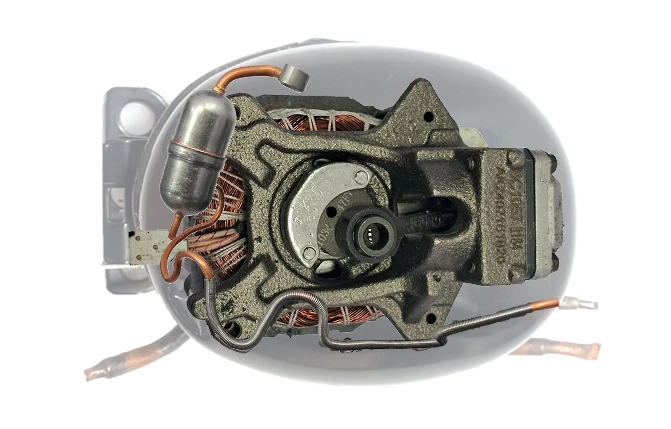

Refrigerator Compressor Should Costing & Benchmarking: BOM, Cost Drivers and Procurement Insights

Discover a detailed teardown and should-cost analysis of a refrigerator compressor used in a 190L single-door model. This study explores BOM insights, cost drivers like motor assem

BLDC Hub Motor Teardown & Should Costing

Our engineers have benchmarked a BLDC motor used in an electric scooter to study its design, BOM and then conducted a zero-based costing exercise on it to get its direct material c

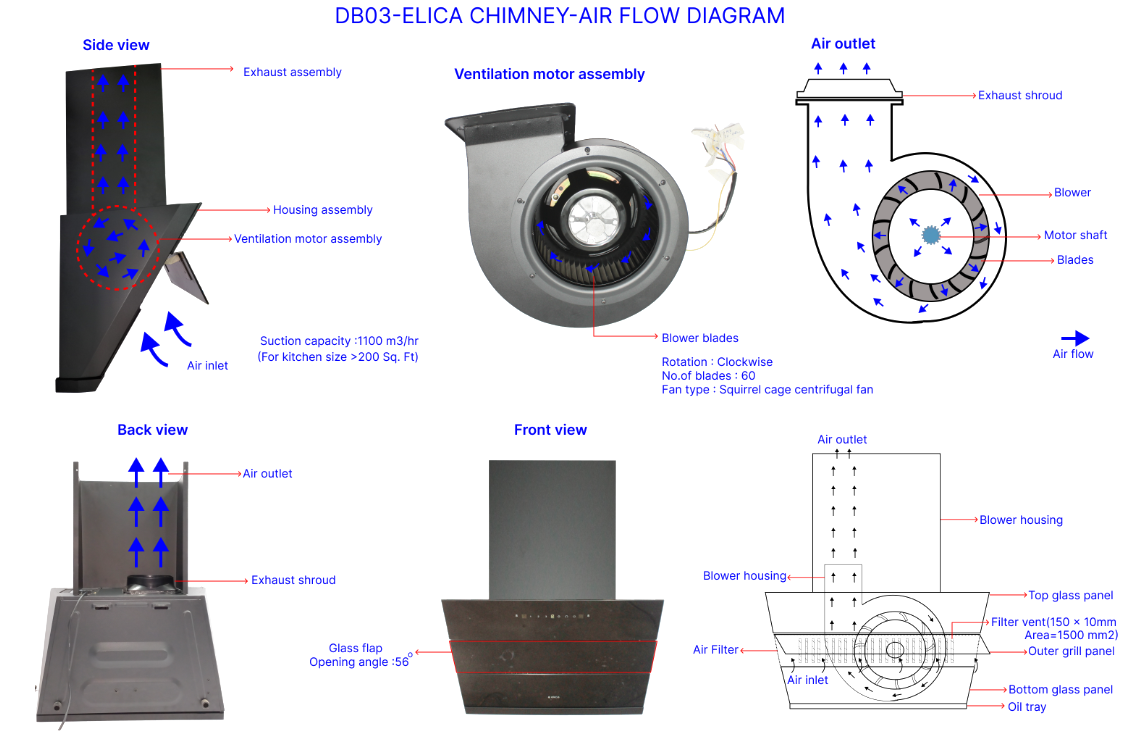

Kitchen Chimney Teardown & Should Costing

How to do teardown benchmarking and zero based costing of a home appliance like kitchen chimney.

Deep Dive into 55HP Agricultural Tractor Part Should Costing & Benchmarking

Bring transparency to tractor manufacturing. Our teardown dissects key systems—engine, transmission, hydraulics—generating a detailed Bill of Materials and cost model. Using sy

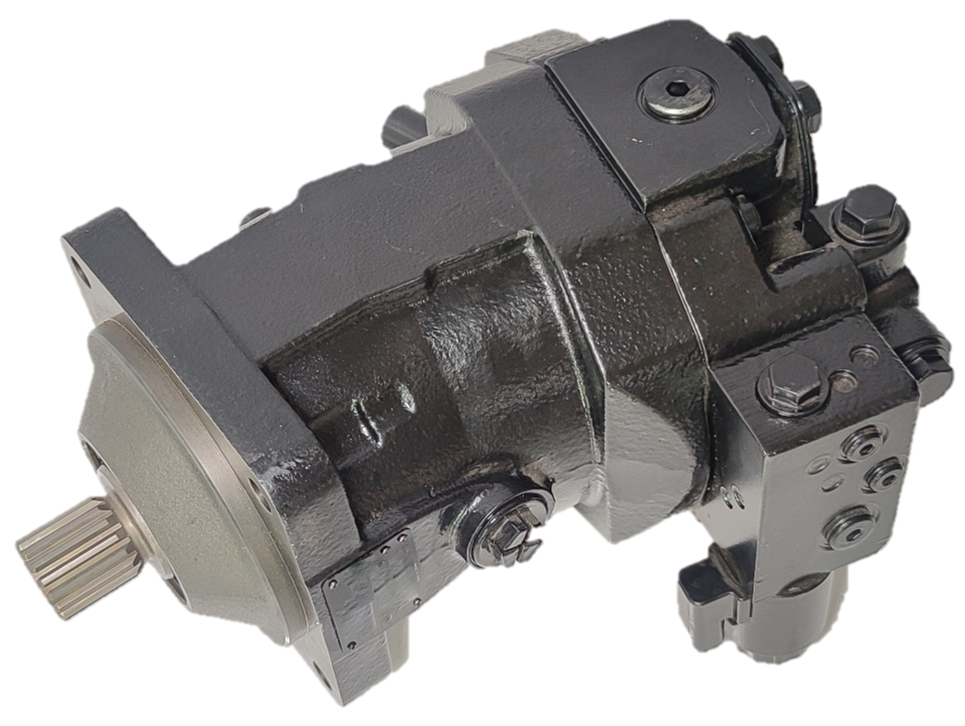

Hydraulic Motor Teardown and Should Cost Analysis

Deep-dive teardown and cost analysis of a hydraulic motor. Includes internal component breakdown, BOM, and should-cost estimation to guide sourcing and engineering decisions.