Mastering Global Sourcing: How Advanced Cost Intelligence and Verified Data Transform Commodity Management

Introduction: Navigating the Complexities of Global Sourcing in Today's Landscape

Global commodity managers operate at the forefront of increasingly volatile and complex supply chains. Their role has evolved significantly beyond mere transactional purchasing, now encompassing strategic value creation, proactive risk mitigation, and fostering innovation across diverse international markets. In the contemporary economic landscape, characterized by intense global competition, rapid economic shifts, and unforeseen disruptions, the imperative for precise cost control and strategic sourcing has reached unprecedented levels. Modern commodity managers are no longer simply buyers; they are strategic architects tasked with ensuring business continuity and competitive advantage.

The daily responsibilities of global commodity managers involve navigating a gauntlet of complex hurdles. These include intricate logistical challenges, the pervasive threat of geopolitical instability, and the perennial struggle for cost transparency and consistent quality across a dispersed supplier base. Such challenges frequently compound, making effective decision-making exceptionally difficult without the appropriate tools and intelligence.

Advanced Structures India (ASI) offers a transformative solution to these challenges through its xcPEP ecosystem, a leading should cost analysis software and cloud-native platform designed to revolutionize cost analysis and procurement. This powerful platform is underpinned by xcPROC, a dynamic data and insights hub that provides continuously updated and verified market intelligence. This report will delve into the core pain points confronting global commodity managers and illustrate how these cutting-edge technologies offer a robust blueprint for precision sourcing, optimal cost management, and a significant strategic advantage in a dynamic global market.

Challenge Area

Specific Pain Point

Impact on business

The Unseen Hurdles: Sourcing & Pricing Pain Points for Global Commodity Managers

Global commodity managers face a multifaceted array of challenges that complicate sourcing, inflate costs, and introduce significant risks. These issues often intertwine, creating a complex operational environment.

Supply Chain Volatility & Disruptions: The New Normal

The modern supply chain is inherently volatile, marked by frequent and often unpredictable disruptions.

Specific Pain Points

Global commodity managers must grapple with an intricate web of complex logistics, which includes diverse regulations, customs procedures, import duties, taxes, tariff classifications, and extensive documentation across numerous countries. Developing nations frequently present additional layers of complexity, such as lower logistics performance and heightened risks of cargo theft. Beyond these procedural hurdles, the global landscape is rife with potential disruptions stemming from

Geopolitical instability and unforeseen events

These can range from geopolitical tensions and natural disasters to trade disputes, labor issues, and global crises like the COVID-19 pandemic or the grounding of a container ship in the Suez Canal. Such events inevitably lead to significant delays, material shortages, and escalating costs.1 Furthermore, the availability of critical

Raw materials

Raw materials can be severely impacted by disrupted global shipping routes or unforeseen events affecting production, such as disease outbreaks hitting agricultural commodities or conflicts impacting factories.4

Impact on Business

Collectively, these challenges result in severe production delays, missed deadlines, substantial increases in operational costs, and potential damage to brand reputation due to unfulfilled commitments or quality issues.5

Broader Implications

The various research sources consistently highlight that logistical complexities are not isolated issues but are often exacerbated by, and deeply intertwined with, geopolitical instability and natural disasters. This interconnectedness creates a cascading effect on material availability, costs, and delivery times. For instance, a geopolitical event can directly impact shipping routes, leading to logistical bottlenecks and subsequent raw material scarcity. This indicates that a solution addressing only one facet, such as merely cost, without considering the broader supply chain resilience and the interplay of these risks, will be inherently limited. Commodity managers require tools that provide holistic visibility and intelligence across these interdependent risk factors to truly mitigate their impact.

The pervasive and constant threat of disruptions necessitates a fundamental shift in strategy for global commodity managers: moving from merely reacting to crises to proactively identifying, assessing, and mitigating potential risks. The frequent and severe impact of supply chain disruptions underscores this need. Reactive problem-solving, such as scrambling to find a new supplier after a disruption hits, is inherently costly, time-consuming, and often leads to suboptimal outcomes. Proactive risk management, enabled by robust data and intelligence, allows for pre-planning—for example, diversifying suppliers, building strategic stockpiles, or identifying alternative sources before a crisis escalates. This elevates the need for predictive analytics and scenario planning capabilities within procurement technology, transforming the function from a reactive cost center into a proactive value driver that ensures business continuity.

The "Black Box" of Costing & Pricing: Lack of Transparency and Accuracy

A significant hurdle for global commodity managers is the opacity and inaccuracy often found in traditional costing methodologies.

Specific Pain Points

Many organizations continue to rely on outdated or generic data for their should cost analysis software or models, utilizing non-region-specific or historical material and labor data for their "should cost" models. This practice leads to estimates that are detached from current market realities and actual supplier capabilities, resulting in significant inaccuracies. A pervasive problem is the

Lack of transparency

In traditional costing tools, which frequently function as a "black box.", transparency is absent. This makes it incredibly difficult for cost engineers and procurement teams to understand the underlying assumptions, calculations, and specific cost drivers behind an estimate. This opacity severely hinders their ability to defend cost targets during supplier negotiations. Furthermore, legacy systems often demonstrate

Difficulty with complex parts

Engineers struggling to accurately estimate costs for highly complex or proprietary components, especially those without detailed 3D models. This limitation extends to specialized items like Printed Circuit Boards (PCBs), where unique fabrication processes, material layers, and intricate component placement are critical cost drivers. Consequently, without precise, real-world, and transparent data, establishing

Inaccurate cost targets for parts and products becomes a guessing game, hindering effective procurement cost optimization and leading to missed cost-saving opportunities, inefficient resource allocation, and a weakened position in supplier discussions.

Impact on Business

The consequences of these issues include suboptimal pricing agreements, significant missed cost-saving opportunities, strained supplier negotiations due to indefensible assumptions, and an inability to effectively validate or challenge supplier quotes.

Broader Implications

The consistent emphasis across various sources on "verified input data" and "transparent logic-driven models" directly addresses the pervasive "black box" issue in costing. This indicates a fundamental shift in how negotiation power is derived in global sourcing: it is increasingly rooted in superior, transparent, and defensible data, rather than solely on traditional bargaining tactics or market leverage. Inaccurate or opaque data, a key pain point, directly leads to a weak and indefensible negotiation position. Conversely, transparent, verified data, a core solution, empowers stronger, fact-based negotiations. The broader implication for global commodity managers is that data quality and transparency are no longer just operational conveniences but paramount strategic assets for achieving favorable pricing, fostering trust, and maintaining healthy, sustainable supplier relationships.

"Should Cost Analysis" is consistently presented not merely as a technical calculation but as a "strategic cost management approach". This signifies that accurate cost intelligence is a vital strategic lever for global commodity managers, crucial for setting realistic and ambitious cost reduction goals, proactively identifying savings opportunities, and fostering more sustainable and collaborative supplier relationships. Defining "what a product

should cost to produce" is a core strategic capability that influences not just procurement, but also product design, engineering decisions, and overall business profitability. For commodity managers, investing in advanced "should cost" tools is therefore an investment in enhancing their strategic capability and competitive positioning, rather than just an operational efficiency upgrade.

Ensuring Quality & Supplier Reliability: The Global Vetting Maze

Maintaining consistent quality and ensuring supplier reliability across a global network presents substantial challenges.

Specific Pain Points

A significant challenge arises from the inconsistent product quality across diverse suppliers and regions. This variability can stem from differing economic conditions, industry practices, and supplier capabilities, often leading to product malfunctions or defects, as famously exemplified by the Samsung Galaxy Note 7 debacle. Beyond quality, the -

Reliability of global suppliers can be severely impacted by external factors such as political instability, economic downturns, natural disasters, labor disputes, and currency fluctuations in their respective countries. Such factors can lead to unforeseen production delays and increased costs. Furthermore -

Vendor management challenges are complex; effectively managing a global network of vendors involves the ongoing task of identifying, vetting, and working with reliable partners who can consistently meet stringent quality standards, deliver on time, and offer competitive pricing.

Impact on Business

These issues collectively risk product integrity, incur substantial reverse supply chain costs (e.g., returns, rework), damage brand reputation, and lead to critical production delays that can ripple across the entire value chain.

Broader Implications

The detailed list of factors impacting supplier reliability—including political stability, economic downturns, natural disasters, and labor disputes 5—indicates that traditional supplier vetting processes, which often focus narrowly on price, quality, and production capacity, are no longer sufficient. A truly comprehensive supplier assessment must now integrate a broader understanding of the macro-environmental and geopolitical risk landscape. This means that for a global commodity manager, a supplier assessment must be incredibly nuanced, requiring a deep understanding of the geopolitical and environmental context of the supplier's operations. This implies a critical need for tools that can provide this broader, real-world intelligence to inform a truly holistic supplier risk assessment, moving beyond simple checks to a comprehensive risk profile.

Maintaining consistent quality control across diverse, geographically distant suppliers is a major hurdle. The research highlights that failures from international sources can have more severe impacts and significantly longer resolution times.6 This necessitates the implementation of robust, proactive quality assurance mechanisms rather than relying solely on reactive inspections. Global quality control is not just about setting standards, but about the practical difficulties of monitoring and rectifying issues across vast distances, different operational standards, and potential communication barriers. This implies a pressing need for solutions that enable early detection and rapid resolution of quality deviations, ideally through data-driven intelligence and continuous monitoring, rather than relying on costly and time-consuming reactive inspections once products have shipped.

Navigating Regulatory Compliance & Trade Barriers: A Legal Minefield

Global sourcing is inherently complex due to the intricate web of international regulations and trade policies.

Specific Pain Points

Global commodity managers must constantly steer through an intricate maze of complex regulatory frameworks, including regulations, tariffs, import-export rules, customs duties, and various trade agreements that vary significantly from country to country. The rise of -

Protectionism, aimed at shielding domestic industries by imposing tariffs on imports, adds further layers of complexity and cost to global sourcing strategies.1 Beyond legal compliance, there is increasing scrutiny from consumers, regulatory bodies, and NGOs regarding

Ethical and social responsibility concerns, including labor exploitation, unsafe working conditions, environmental damage, and a general lack of corporate accountability in global supply chains.5 In specific sectors, such as healthcare,

Maintaining compliance with strict laws like the Health Insurance Portability and Accountability Act (HIPAA), FDA guidelines, and CMS rules is paramount. Failure to comply can lead to severe legal and financial consequences.

Impact on Business

Non-compliance can result in severe legal repercussions, substantial financial penalties, debilitating import restrictions, and significant damage to a company's brand reputation and market standing.

Broader Implications

The severe legal and financial consequences of non-compliance elevate regulatory adherence from a mere checklist item to a critical strategic imperative for global commodity managers. This implies that procurement technology must actively support meticulous record-keeping, comprehensive supplier vetting for compliance, and continuous monitoring of evolving global regulations. Compliance is not merely an operational detail; it is a fundamental strategic requirement that can directly impact a company's financial health and legal standing. For global commodity managers, this means that compliance checks and ethical sourcing considerations must be integrated into their sourcing decisions from the very outset. This, in turn, implies a strong need for systems that can track, verify, and document supplier adherence to diverse global standards and ethical guidelines.

Inefficient Negotiation & Vendor Management: The Human and Data Gap

Inefficiencies in negotiation and vendor management often stem from a lack of comprehensive data and effective communication.

Specific Pain Points

A common mistake is focusing solely on price during negotiations without sufficient, thorough market and supplier research, leading to data-poor negotiations. This often results in suboptimal deals, missed value opportunities, and can strain long-term supplier relationships.10 Global sourcing inherently involves overcoming significant

Communication barriers, including time differences, language barriers, and differing national holidays. These can severely delay problem resolution, lead to misunderstandings, and even bring the entire supply chain to a halt. Commodity managers constantly face the delicate balancing act of achieving aggressive

Cost savings while maintaining quality. This often requires extensive due diligence and a deep understanding of supplier capabilities. A pervasive issue is the

Lack of visibility in processes, meaning a clear, holistic view into procurement operations. This uncertainty often leads to inefficient spend management, unexpected delivery delays, and compromised supplier relationships, as decisions are made based on incomplete or outdated information.

Impact on Business

These inefficiencies result in missed opportunities for value creation, prolonged and frustrating negotiation cycles, and the erosion of trust with key suppliers, ultimately undermining long-term partnerships.

Broader Implications

The strong emphasis on "thorough market and supplier research," the use of "sales intelligence tools," and "data analytics" for successful negotiation, coupled with the concept of "integrative negotiation", suggests a significant shift in negotiation strategy. It is moving away from adversarial haggling towards data-backed, collaborative value creation. Modern negotiation is no longer about raw power or relentless haggling, but about informed, data-driven discussions aimed at finding mutually beneficial outcomes. For global commodity managers, this means that the quality and transparency of their cost and market data directly influence their ability to secure favorable terms and build sustainable, collaborative supplier relationships, transforming negotiation into a more strategic and less confrontational process.

The research repeatedly identifies a lack of visibility in procurement processes as a root cause for a multitude of issues, ranging from inefficient spend management to unexpected supply chain disruptions. This fundamental problem underscores the urgent need for centralized, accessible data platforms that provide a holistic view of procurement operations. If global commodity managers cannot see what is truly happening across their complex supply chain, they cannot manage it effectively, leading to reactive decision-making based on incomplete information. This strongly reinforces the value proposition of integrated platforms that centralize procurement data and provide a holistic, real-time view, thereby enabling informed decision-making, proactive problem-solving, and ultimately, greater control over the entire sourcing process.

xcPEP & xcPROC: Your Blueprint for Precision Sourcing & Cost Optimization

Advanced Structures India's xcPEP and xcPROC platforms offer a comprehensive, integrated solution designed to address the critical pain points faced by global commodity managers, transforming traditional sourcing into a strategic, data-driven discipline.

xcPEP: The Power of Cloud-Native Should Cost Analysis and Apriori Alternative

xcPEP is a purpose-built Cost Engineering Software and SaaS platform designed specifically for cost engineering and procurement teams, moving beyond older tools primarily used for rough design estimates. It stands out as a premier should cost analysis software.

Core Functionalities & Value Proposition

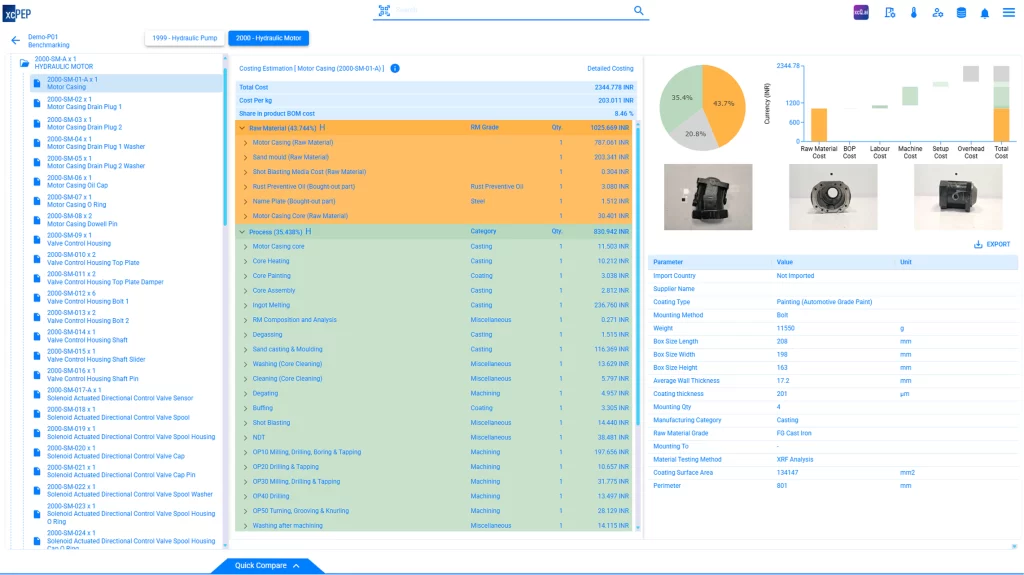

xcPEP delivers real-world process accuracy by basing its cost models on detailed, region-specific manufacturing logic and rates, unlike legacy tools that rely on generic logic. It integrates seamlessly with xcPROC to ensure material prices, labor costs, and machine rates are continuously updated, providing estimates that accurately mirror current market conditions and shop-floor realities. The platform offers

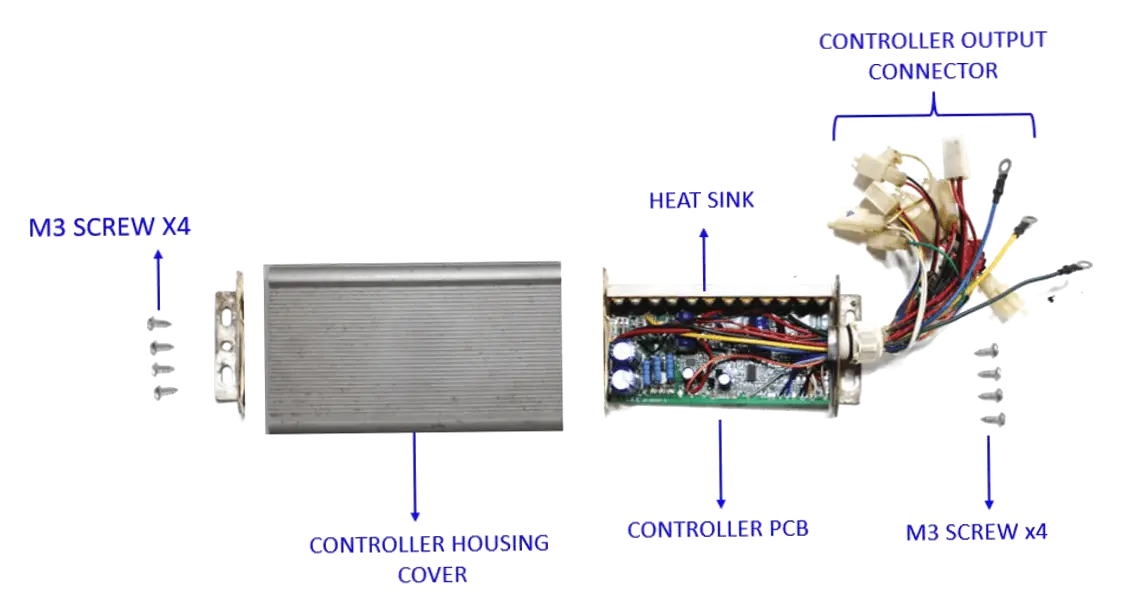

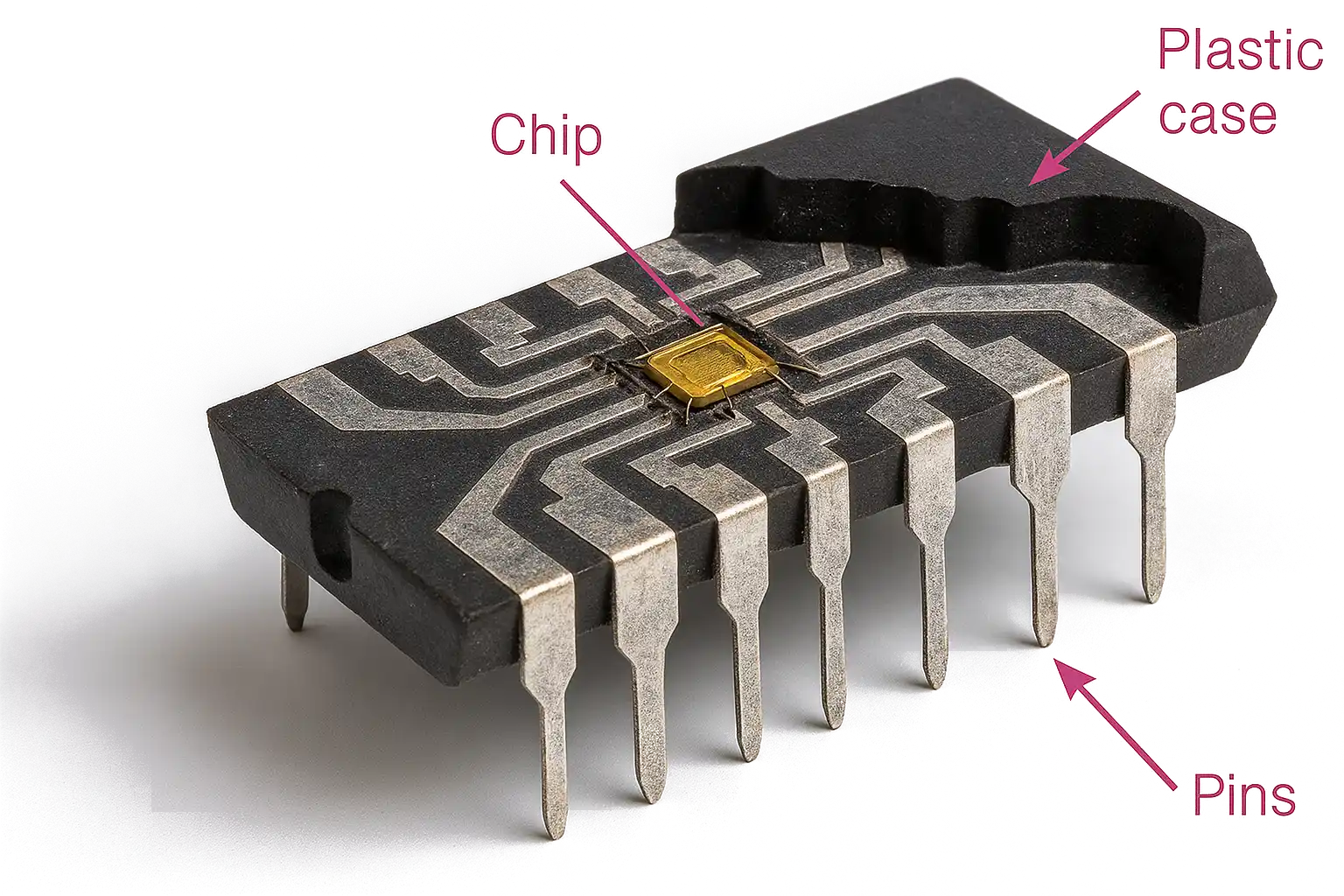

Comprehensive costing capabilities, making it a robust manufacturing should cost software and product costing software. It is designed to accurately estimate costs for a vast array of parts, including complex proprietary components (even without detailed 3D models) and specialized, highly accurate PCB costing. It accounts for unique fabrication processes, material layers, and intricate component placement. Its library covers a wide range of manufacturing processes across diverse industries like automotive, off-highway, home appliances, and consumer electronics.7 A key differentiator is its

Full transparency and traceability, eliminating the "black-box" issue prevalent in many costing tools. xcPEP functions as a transparent cost modeling software, making every assumption and calculation visible, allowing users to drill down into each cost driver (materials, labor, overhead, etc.), ensuring every cost model is built on defensible assumptions, fostering trust and clarity.8 Furthermore, its

Intuitive cloud-native design delivers superior speed and performance, even with complex assemblies. Its user-friendly interface is designed for a shorter learning curve and easier adoption across teams, contrasting sharply with the clunky interfaces and slow performance of older, on-premise systems. It also benefits from zero downtime and automatic updates.

Key Benefits for Commodity Managers

xcPEP enables procurement and cost engineering teams to achieve faster, more accurate cost targets with significantly less effort and overhead, thereby accelerating should costing software workflows and decision-making cycles.8 Advanced Structures India claims xcPEP offers "one-third the cost of ownership" compared to legacy

Should cost analysis software, resulting in a reduced total cost of ownership (TCO). This is achieved through its lean cloud architecture, modern tech stack, streamlined development, and automated SaaS onboarding, translating into substantial savings on subscription, support, and IT infrastructure. The platform is -

Designed for key use cases, purpose-built to support critical cost engineering and procurement activities, including early design cost validation, preparing "fact packs" for robust supplier negotiation cost analysis, competitor product benchmarking, and effectively managing cost reduction software for procurement programs within a unified platform. Its modular design and built-in guidance significantly reduce the need for large internal cost engineering teams or extensive external consultants, offering

Scalability and reduced dependence. This empowers even smaller OEMs and Tier suppliers to build and operate their own in-house cost labs with minimal outside support.

Broader Implications

The confluence of xcPEP's lower Total Cost of Ownership (TCO) and its design for reduced dependence on large teams or consultants indicates a significant shift in the market. Sophisticated "should costing" capabilities, traditionally the domain of large enterprises with substantial resources, are now becoming accessible to a much broader market, including mid-sized companies and Tier suppliers. Historically, advanced cost engineering software and the specialized teams required to operate it were prohibitively expensive for many companies. xcPEP's cloud-native, intuitive, and modular design, coupled with its lower TCO, suggests a strategic move to democratize access to these critical capabilities. This levels the playing field, allowing a wider range of companies to gain a competitive edge through precise cost intelligence and in-house expertise, rather than being limited by budget or headcount.

xcPEP's emphasis on continuous updates and its seamless integration with xcPROC's dynamic, continuously refreshed data represents a fundamental shift. It moves beyond static, periodic cost estimates to a continuous, real-time cost intelligence for procurement. The platform's "real-world process accuracy" and "verified input data" are explicitly stated as being "continuously refreshed and validated" via integration with xcPROC. This is a critical functional distinction. In a volatile global market where material prices, labor rates, and manufacturing processes constantly evolve, static cost libraries quickly become obsolete. A system that continuously updates its underlying inputs allows commodity managers to have real-time, accurate "should costs," enabling dynamic pricing strategies, agile responses to market fluctuations, and transforming cost estimation from a periodic exercise into a continuous stream of actionable cost intelligence.

xcPROC: The Intelligence Hub for Verified Data & Supplier Insights

xcPROC functions as a structured database and a data and insights platform, supporting should costing, supplier evaluation, and part procurement across various industries.

Core Functionalities & Value Proposition

xcPROC is built around structured and dynamic databases containing curated and actively maintained datasets on raw materials, machines, operations, labor, standard parts, suppliers, and currency. This data is continuously expanded and updated by ASI’s dedicated internal data research team, driven by real project requirements and custom client needs. The platform offers

Comprehensive vendor discovery and evaluation through detailed supplier profiles that go beyond basic contact information. These profiles include in-depth manufacturing capabilities, business information, financial data, customer associations, certifications, and downloadable product catalogs, all presented in a clear, structured format for effective shortlisting, risk evaluation, and sourcing decisions.12 xcPROC also integrates a unique

Marketplace feature, allowing users to directly access supplier profiles and place part orders through the same interface. Each listed part includes detailed technical specifications, price–quantity data, and ordering options linked to known manufacturers, with potential manufacturers also mapped through capability analysis.12 A cornerstone of xcPROC's reliability is its

Rigorous data collection and validation. Every dataset on the platform is independently collected, rigorously validated, and meticulously maintained by the ASI Data Research Team, ensuring unparalleled accuracy and trustworthiness.12

Key Benefits for Commodity Managers

xcPROC serves as the data backbone, powering all should costing software models in xcPEP with real production parameters, providing an accurate cost estimation foundation. This eliminates reliance on generic averages or static reference tables, ensuring highly accurate cost estimates and avoiding costly guesswork. The detailed supplier profiles and capability mapping support data-backed shortlisting, significantly accelerating supplier qualification and reducing onboarding time, leading to

Enhanced supplier evaluation and strategic sourcing. It also enables the proactive identification of feasible alternative suppliers, crucial for supply continuity and risk reduction, making it a powerful data-driven sourcing platform. By replacing generic assumptions with granular, part-level data tied to real manufacturing contexts, xcPROC ensures that cost models are

Transparent and defensible. This data mirrors shop-floor reality, building confidence and trust in cost analyses. For xcPEP subscribers, xcPROC automatically keeps core cost inputs like raw material prices, currency rates, labor hour costs, and machine hour rates updated, providing

Real-time cost inputs. This eliminates manual effort and ensures that "should cost" models are always aligned with current market conditions.

Broader Implications

The emphasis that xcPROC's data is "dynamic and engineering-led," actively maintained by ASI’s internal data research team 12, represents a subtle yet profound distinction. It implies that the data is not merely collected or broadly aggregated; it is meticulously curated, validated, and contextualized by experts who possess a deep understanding of manufacturing processes and global supply chain nuances. This is a critical differentiation from generic data providers. It signifies that the data is not just raw information but has been processed and validated by experts who understand the intricacies of manufacturing processes, material science, and global market dynamics. For a global commodity manager, this translates to significantly higher confidence in the data's accuracy and relevance, especially for highly engineered parts or niche markets. This expert-curated data is crucial for making truly defensible cost and sourcing decisions, moving beyond mere data availability to data intelligence.

xcPROC offers far more than just a static list of supplier contacts. Its detailed profiles, capability mapping, and integrated marketplace feature transform it into a comprehensive strategic intelligence hub for supplier evaluation, risk mitigation, and proactive vendor base development. The platform's "Vendor Discovery and Evaluation" features, including "detailed manufacturing capability, business information, and financial data," "known and potential parts mapped," and "customer associations, certifications", go significantly beyond what a traditional supplier directory provides. The implication is that xcPROC is designed to provide strategic intelligence, enabling global commodity managers to not only find potential suppliers but also to deeply evaluate their fit, assess inherent risks (e.g., financial stability, certifications), and proactively identify alternatives for enhanced supply chain resilience. This transforms supplier management from a reactive, administrative task into a strategic capability that supports long-term sourcing goals.

The Synergy: How xcPEP and xcPROC Deliver Unmatched Value

The true power of the Advanced Structures India ecosystem lies in the seamless integration between xcPEP and xcPROC. xcPROC serves as the dynamic data backbone, continuously feeding xcPEP, the should cost analysis software, with verified, real-time, and engineering-led data on materials, labor, machines, and suppliers. This symbiotic relationship ensures that every "should cost" model generated by xcPEP is grounded in the most current and accurate market realities, eliminating the guesswork and inaccuracies often associated with traditional costing methods.

This integration empowers global commodity managers with unparalleled transparency and defensibility in their cost analyses and supplier negotiations. With xcPEP, they can drill down into every cost driver, confident that the underlying data from xcPROC is validated and region-specific. This allows for data-driven discussions with suppliers, fostering trust and enabling more favorable, mutually beneficial agreements. Furthermore, the combined intelligence of xcPEP's costing capabilities and xcPROC's detailed supplier insights facilitates proactive risk management and strategic sourcing decisions, moving organizations from reactive problem-solving to anticipatory planning. By leveraging this integrated ecosystem, commodity managers can optimize pricing, enhance supplier relationships, and build more resilient and efficient global supply chains, ultimately securing a significant competitive advantage in a complex and volatile market. This makes it an ideal global commodity manager software and a powerful suite of strategic sourcing costing tools.

Conclusions

The landscape of global commodity management is characterized by persistent and evolving challenges, from supply chain volatility and opaque costing to quality control issues and complex regulatory environments. These hurdles demand a fundamental shift towards more data-driven, transparent, and proactive sourcing strategies. Traditional approaches, often reliant on outdated information or reactive measures, are no longer sufficient to navigate the complexities of global procurement effectively.

The xcPEP and xcPROC ecosystem from Advanced Structures India offers a compelling solution to these deeply entrenched problems. xcPEP, as a cloud-native should costing software and should cost analysis software, provides unprecedented accuracy, transparency, and speed in cost analysis, moving beyond the limitations of legacy "black box" tools. Its ability to handle complex parts and provide defensible cost targets empowers procurement teams in negotiations. Complementing this, xcPROC acts as a vital intelligence hub, delivering continuously updated, engineering-led data and comprehensive supplier insights that enable robust vendor evaluation and proactive risk mitigation, making it a comprehensive procurement cost analysis software.

The combined power of xcPEP and xcPROC represents a transformative approach to global sourcing. This integrated system democratizes advanced cost engineering, making sophisticated capabilities accessible to a broader range of manufacturers. It shifts the paradigm from static cost estimates to dynamic real-time cost intelligence for procurement, ensuring that sourcing decisions are always aligned with real-time market conditions. By leveraging this ecosystem, global commodity managers can transition from a reactive posture to one of strategic foresight, enhancing their negotiation power, fostering stronger supplier relationships, and building more resilient, cost-optimized supply chains. Embracing such advanced costing tools for global sourcing and verified data is no longer merely an operational improvement; it is a strategic imperative for achieving sustainable competitive advantage in the global market.