The Definitive Guide to Electronics Should Costing in Automotive, EV, and Off-Highway Industries: Master Cost Control and Drive Innovation

Introduction: Navigating the High-Stakes World of Automotive Electronics Costs and EV Cost Optimization

The Escalating Role of Electronics in Modern Vehicles

The landscape of modern vehicle manufacturing is undergoing a profound transformation, driven significantly by the escalating integration of electronic systems. These sophisticated components are no longer merely supplementary features but are becoming the very essence of vehicle functionality, safety, and user experience. This pervasive integration has led to a dramatic increase in the proportion of electronics within a vehicle's total cost.

Historically, in the 1970s, electronics represented only 5% to 10% of a car's price, primarily limited to basic functions like fuel injection. By the turn of the millennium, this figure had more than doubled to 22%, and by 2020, it reached approximately 40%. Projections for 2030 are even more striking, with electronics anticipated to account for up to 50% of a vehicle's value, and specifically in electric vehicles (EVs), potentially reaching 35% even when excluding battery systems. This exponential growth is fueled by the widespread adoption of advanced technologies such as Advanced Driver Assistance Systems (ADAS), complex infotainment systems, numerous Electronic Control Units (ECUs) managing diverse vehicle functions, and an array of environmental sensors.

The Challenge of Cost Management in Software-Defined Vehicles

This rapid expansion of electronic content presents a critical challenge for manufacturers: how to effectively manage and control costs in an increasingly complex and dynamic environment. The traditional hardware-centric approach to cost analysis, while still fundamental for physical components, must evolve.

The increasing prevalence of "Software-Defined Vehicles" (SDVs) means that software is no longer a static element but an evolving, continuous cost driver. The development, integration, and ongoing maintenance of automotive software, including over-the-air (OTA) updates and cybersecurity measures, introduce significant and often less transparent cost implications. Software, unlike hardware, does not simply degrade; it continuously evolves or decays based on how it is managed, necessitating a more holistic costing methodology that accounts for both the tangible hardware and the intricate, dynamic software components.

Should Costing: A Strategic Imperative for Cost Control

In this high-stakes environment, "should costing" emerges as a strategic imperative for achieving robust cost control and sustaining competitive advantage. Should costing, also known as cost breakdown analysis, is a powerful methodology that employs "clean-sheet" techniques to generate a bottom-up estimate of a supplier's true production costs and margins. Its primary objective is to differentiate between the quoted price of goods or services and their inherent, true value. This method involves meticulously dissecting a product into its fundamental components and analyzing the costs associated with raw materials, labor, manufacturing processes, overheads, and profit margins. It has earned its reputation as the "gold standard" for hardware purchases within the automotive industry.

This approach represents a significant shift from reactive cost management to a proactive strategy. Should-cost analysis enables organizations to estimate product costs before a Request for Proposal (RFP) is even issued, thereby establishing a crucial benchmark for evaluating competitive bids. This proactive stance is vital for advanced companies aiming to optimize profitability during the design phase, where cost is effectively "baked" into the product, rather than attempting to reduce costs downstream after significant investments have been made or supplier commitments finalized. This upstream integration of cost management provides a substantial competitive advantage in rapidly evolving sectors.

This guide will provide a comprehensive roadmap, detailing the step-by-step process of implementing electronics should costing. It will address common challenges faced by manufacturers, explore advanced techniques and emerging trends, and demonstrate how the xcPEP software can empower organizations on this critical journey towards mastering cost control and driving innovation in automotive, EV, and off-highway electronics.

What is Electronics Should Costing? Defining True Value for Automotive and EV Components

Beyond the Quote: The Clean-Sheet Approach to Electronics Cost Estimation

At its core, should costing is a methodology that fundamentally redefines how product costs are understood and managed. It moves beyond simply accepting a supplier's quoted price or comparing various bids. Instead, it relies on a "clean-sheet, bottom-up model of the production process" to accurately estimate what a product should cost under optimal, efficient, and competitive market conditions. This provides an objective, fact-based benchmark for price negotiations with suppliers.

The power of this approach lies in its ability to dissect complex product costs, transforming what might appear as a "black box" into a transparent, granular breakdown of all relevant cost drivers and deliverables. For intricate electronic assemblies, where costs can easily be obscured by aggregated pricing, this level of transparency is indispensable for effective management. Detailed teardowns of components like motor controllers and radar sensors illustrate how granular analysis of Bill of Materials (BOMs), material composition, and manufacturing processes reveals precise cost drivers, allowing for targeted optimization.

Core Components of Electronics Should Cost: Materials, Labor, Overheads, and Profit

A comprehensive should-cost analysis meticulously itemizes the cost of a product into its various constituent elements, commonly referred to as "cost drivers." These typically include the cost of materials, direct and indirect labor, manufacturing processes, overheads, and the supplier's profit margin, alongside considerations of prevailing market conditions. For electronic products, materials constitute a particularly significant portion, averaging around 60% of the total product cost. This high proportion immediately highlights material selection and sourcing as primary levers for cost reduction.

The key cost categories typically encompassed in a should-cost analysis include:

Materials: This category includes raw materials, such as semiconductors, various metals (e.g., copper, aluminum), and plastics, as well as purchased parts and pre-fabricated components.

Labor: This covers both direct labor costs, such as the wages and time involved in manufacturing and assembly, and indirect labor, which includes salaries for non-production staff and administrative expenses.

Conversion Costs: These are expenses incurred in transforming raw materials into finished products. This encompasses manufacturing expenses, utility costs, and maintenance associated with production processes.

Logistics: This involves all costs related to moving the product through the supply chain, including shipping, freight, customs duties, warehousing, and distribution.

Subcontracting: Expenses associated with outsourcing specific manufacturing or assembly obligations to third-party providers.

Tooling: This refers to the costs for specialized equipment, molds, dies, and fixtures required for specific manufacturing processes.

Quality Control & Testing: These are the expenses incurred for inspecting and validating product reliability, performance, and compliance with standards.

Profit Margin: The expected profit for the supplier or manufacturer, which is a critical component in understanding the total quoted price.

Global Supply Chain Dynamics and Cost Drivers

The interconnectedness of these cost drivers within a complex global supply chain ecosystem is a critical consideration. For example, the availability and price of raw materials like copper, silicon, and rare-earth metals are profoundly influenced by global demand, geopolitical events, and unforeseen disruptions such as pandemics. Furthermore, the imposition of tariffs on semiconductors and other upstream inputs can significantly increase costs and impact component availability. The globally diversified supply chains typical for consumer electronics, which share many components and dynamics with automotive electronics, are particularly vulnerable to natural disasters, geopolitical tensions, and material shortages, often leading to increased production costs and delivery delays. Therefore, truly effective should costing must integrate robust market intelligence, geopolitical risk assessment, and dynamic supply chain analysis to provide accurate, predictive, and resilient cost estimates. It is about understanding the systemic vulnerabilities that can inflate costs across the entire product lifecycle.

Table 1: Key Cost Drivers in Electronics Should Costing

Cost Category

Description

Impact on Electronics

Typical Percentage Range

How to Implement Electronics Should Costing: A Step-by-Step Guide for Automotive & EV

Implementing a robust electronics should costing methodology requires a systematic, multi-stage approach, leveraging detailed data, advanced modeling techniques, and strategic insights.

Step 1: Comprehensive Data Acquisition & Teardown Analysis for Electronics Costing

The foundation of accurate should costing is the acquisition of precise, granular data. This process begins with:

Detailed Bill of Materials (BOM) Generation and Part-Level Parameter Mapping

This crucial initial step involves meticulously mapping every component and attribute of the product. The foundation of accurate should costing relies on precise, granular data captured at this stage.

Mapping Electrical Component Parameters

For electrical components, this includes detailed information on semiconductors, Printed Circuit Board (PCB) attributes such as the number of layers, material type, and component placement, and manufacturer references.

Mapping Mechanical Component Parameters and Lab Testing

For mechanical parts, the BOM extends to detailed measurements like box size, surface area, and perimeter, alongside raw material specifications, including grade and form. In cases where material composition is uncertain, lab testing can be conducted to determine precise material identification, with certified test reports directly uploaded to the BOM.

Leveraging Physical Teardowns and Engineering Drawings for Granular Data

Data for the BOM and part-level parameters is primarily gathered through physical teardowns of existing products, detailed interpretation of 2D engineering drawings, or direct extraction from 3D CAD models, depending on the available information for the component. Product teardown analysis is a powerful technique that involves disassembling a product to gain a deep understanding of its components, manufacturing processes, and underlying cost structures. This process provides invaluable insights for identifying design improvements and opportunities for cost reduction. It is particularly effective for competitor benchmarking, allowing companies to understand how rival products are constructed and where cost differences arise.

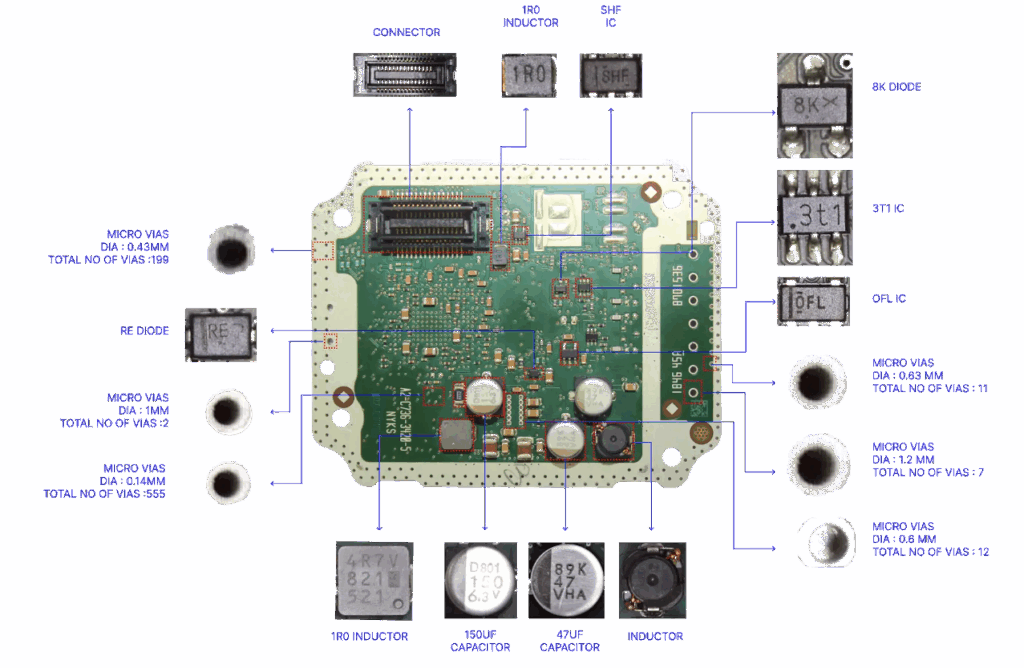

Advanced Data Capture: The Role of AI-Based PCB Component Identification

Traditionally, identifying every component on a PCB for electronics should costing is a critical yet time-consuming and error-prone task, especially for complex assemblies or large teardown programs. Manual identification struggles with scalability and consistency.

Advanced solutions address this challenge by utilizing calibrated imaging setups and Artificial Intelligence (AI) to automatically detect and classify all mounted components, such as Integrated Circuits (ICs), resistors, capacitors, transistors, and diodes, without requiring manual tagging. Each identified part is then matched against a comprehensive database to automatically populate fields like item name, description, quantity, manufacturer, and Manufacturer Part Number (MPN). This automation significantly reduces lead times and ensures consistent, reviewable inputs for cost model generation.

The accuracy and reliability of should costing, particularly when moving towards predictive analytics and AI-driven insights, are directly dependent on the quality and consistency of this initial data capture. Inefficient data management and fragmented information across departments can act as a hidden cost driver, leading to inaccurate estimates and missed opportunities. Automated, AI-powered data capture is therefore not just a convenience but a strategic necessity for achieving reliable, scalable, and future-proof cost analysis.

Step 2: Building Accurate & Dynamic Electronics Cost Models

Once comprehensive data is acquired, the next step involves translating this raw information into actionable cost models.

Developing Configurable and Custom Cost Models for Diverse Electronics Manufacturing Processes

Should costing relies on "clean, process-wise cost models" that are built with actual manufacturing logic, including detailed routing, machine time, tool wear, and regional cost inputs. These models simulate each operation using real machine data, labor inputs, and regional assumptions, resulting in a calculated cost that accurately reflects how the part would be produced on a shop floor.

Advanced platforms provide structured, editable cost models tailored for a wide range of manufacturing processes relevant to electronics, such as Surface Mount Technology (SMT) placement, soldering, PCB fabrication, injection molding for enclosures, CNC machining, ultrasonic welding, and thermal pad application. For unique costing needs, users can also build fully custom models by defining process steps and assigning formulas. The future of should costing lies in creating a "digital twin" of the manufacturing process, where design data, real-world production parameters, and live market intelligence are interconnected. This "digital thread" allows for highly accurate, dynamic cost modeling that reflects actual production behavior, enabling proactive design optimization and rapid scenario analysis.

Integrating Real-World Inputs: Regional Material Rates, Labor Costs, and Machine Hour Rates

To ensure the accuracy of cost models, it is imperative to incorporate up-to-date and region-specific input rates. This includes precise raw material prices based on region and grade, accurate machine hour rates, and realistic labor costs. A centralized database, such as xcPROC, plays a critical role by providing live component pricing, detailed specifications, and availability data. This database also contains machine hour rates that are meticulously built from factors like capital cost, installation cost, operating life, effectiveness, power consumption, maintenance rate, and bed size, ensuring that the calculated machine hour rates reflect the true operating cost of equipment over time.

Calculating Realistic Overheads: Beyond Flat Percentages

A common pitfall in cost estimation is applying a flat percentage for overheads. For truly accurate should costing, overheads must be mapped in detail, defining individual cost components such as machine overhead, labor overhead, tool overhead, setup cost, and rejection losses separately. These values are calculated based on how each is actually incurred during production, using inputs like cycle time, tool life, operator involvement, and process scrap. This granular approach ensures that overhead is applied in a way that mirrors real plant behavior, providing better cost visibility and control.

Step 3: Analyzing Cost Gaps & Identifying Cost Optimization Opportunities

With accurate cost models in place, the focus shifts to analysis and identification of opportunities for improvement.

Performing Detailed Cost Breakdown Analysis: Pinpointing Major Cost Drivers

Should costing provides a clear, defensible breakdown of the expected part cost, encompassing raw materials, machine operations, and overheads. This allows for a line-by-line cost breakdown, precisely identifying where cost differences arise due to choices in material, manufacturing process flow, or sourcing decisions. This granular analysis helps pinpoint the most significant cost drivers, directing optimization efforts where they will have the greatest impact.

Scenario Simulation and Comparative Analysis for Design and Sourcing Decisions

The ability to simulate various scenarios is vital for proactive cost management. This involves modifying key inputs like production volume, material grade, process route, or supplier location to evaluate their impact on cost. Advanced software allows for the creation and comparison of multiple scenarios, providing graphical views that clearly show cost deltas and highlight key drivers. Comparative studies, particularly benchmarking against competitor products, are significantly more effective for cost reduction (up to 40% more effective) than absolute cost analysis, as they reveal industry best practices and cost-effective solutions that can be challenged against internal practices.

Uncovering Hidden Costs and Driving Value Engineering

Beyond direct cost drivers, should costing helps uncover hidden inefficiencies and unnecessary expenses that may not be immediately apparent from a superficial price quote. For instance, a seemingly minor change in PCB pad layout or connector orientation can indirectly impact tooling requirements, manufacturing yield, or rework effort, leading to costs that are not visible from the part price alone. This meticulous analysis ensures that all cost-impacting factors are identified and addressed.

This comprehensive approach to cost analysis moves beyond simple cost reduction to genuine Value Engineering (VE). Should costing is not merely about cutting expenses; it is about optimizing value by making informed decisions on feature sets, material choices, and manufacturing processes that deliver the required functionality at the lowest lifecycle cost. This strategic shift ensures that cost reductions do not compromise product quality, performance, or safety, which is particularly critical for automotive electronics.

Step 4: Driving Electronics Cost Reduction Through Strategic Implementation

The insights gained from should costing are then translated into actionable strategies for cost reduction and value enhancement.

Applying Design for Manufacturability (DFM) and Design for Assembly (DFA) Principles

DFM and DFA are critical methodologies for embedding cost efficiency early in the product development cycle. These principles aim to reduce manufacturing costs, improve efficiency, and enhance product quality by simplifying production and assembly line processes. Key DFM/DFA strategies include minimizing the number of parts in an assembly, utilizing standard and off-the-shelf components over custom ones, optimizing designs for automated assembly, selecting cost-effective and readily available materials, and designing for ease of fabrication and assembly. Early adoption of DFM/DFA principles reduces design complexity, minimizes engineering rework, and prevents costly manufacturing errors downstream.

Optimizing Component Selection: Flexibility, Simplification, and Standardization

Given that materials can constitute up to 60% of an electronic product's cost, flexibility in component choices is paramount. This involves proactively exploring alternative, lower-cost components that still meet functional, performance, and durability requirements, rather than locking into specific parts early in the design process.

Best practices include prioritizing off-the-shelf components, avoiding rare or hard-to-find parts, using uniform component sizes and tolerances, and consolidating part mixes to reduce labor in ordering, stocking, and assembly. Simplifying designs by reducing the total number of semiconductors, connectors, and cables, or removing non-critical features, is a significant cost reduction strategy.

Strategic Supply Chain Optimization: Diversification, Lean Practices, and Global Sourcing

Supply chain optimization is a cornerstone for achieving long-term cost savings and building resilience in the face of market volatility. Key practices include supplier diversification to mitigate risks associated with reliance on a single source, dual sourcing for critical components, and maintaining inventory buffers to prevent production delays. Improving supply chain visibility through better supplier engagement and integrated management software enhances decision-making and overall resilience. Implementing lean principles across the production process helps eliminate waste, reduce excess inventory, and improve overall production efficiency. Furthermore, exploring and leveraging global sourcing opportunities for cost-effective components and materials, while establishing strong partnerships, ensures a stable and efficient supply chain.

Integrating Value Analysis/Value Engineering (VA/VE) for Enhanced Value

VA/VE is a systematic, creative approach aimed at identifying unnecessary costs in products, processes, or services while maintaining or improving quality, performance, and customer satisfaction. It focuses on analyzing the function of a product and finding alternative ways to achieve those functions at a lower overall cost without compromising quality, utility, or lifespan. Should costing provides the essential data and insights for VA/VE exercises, allowing teams to pinpoint exact cost reduction opportunities and validate supplier quotations with confidence. This includes strategies like "decontenting" (identifying and removing nonessential components or features that contribute significantly to cost without negatively impacting customer value). The interplay between design, sourcing, and manufacturing is crucial for holistic cost control. Should costing provides the data and insights to inform decisions at each stage, ensuring that cost savings are realized without compromising product quality or performance.

Strategy Category

Specific Practice

Benefit/Impact

Navigating the Complexities: Challenges in Electronics Should Cost Analysis: Automotive, EV, and Off-Highway

While the benefits of electronics should costing are substantial, its implementation is not without significant challenges, particularly within the dynamic automotive, EV, and off-highway sectors.

Managing Vast & Disparate Data: The Electronics Costing Integration Challenge

One of the foremost challenges is the sheer volume and disparate nature of the data required for comprehensive should-cost analysis. Integrating vast amounts of data from multiple sources—including Bill of Materials (BOMs), CAD models, ERP systems, and supplier quotes—is inherently complex and highly prone to errors when relying on traditional methods like spreadsheets.

This fragmented approach often leads to critical issues such as version control problems, inconsistent data across different teams, and a high risk of inaccuracies due to manual data entry. The absence of centralized product costing systems means that data remains scattered across various departments, preventing a unified, aligned view of cost drivers. This "data silo" effect acts as a hidden cost driver in itself, leading to inaccurate estimates, delayed decision-making, and missed opportunities for cost savings. Achieving fundamental operational efficiency and accuracy in should costing necessitates a unified, real-time data platform that can consolidate and manage this complex information seamlessly.

Coping with Market Volatility: Semiconductor Shortages & Raw Material Costs

The electronics supply chain is highly susceptible to external disruptions, making market volatility a persistent challenge for should costing. Raw material prices, energy costs, and currency exchange rates constantly fluctuate, directly impacting product costs. Geopolitical tensions, natural disasters, and unforeseen events can lead to severe material shortages, as evidenced by the impact of the COVID-19 pandemic on cellular phone imports or the Russian invasion of Ukraine on neon gas supply for chip manufacturing.

The semiconductor industry, a critical backbone for automotive electronics, is particularly sensitive to trade policy shifts and tariffs, which can significantly increase costs and impact availability. For instance, the surging demand for electric vehicles has intensified the need for materials like copper, leading to shortages and affecting component prices. In such volatile markets, should costing extends beyond predicting a single "should cost" number. It becomes a tool for strategic resilience planning. By modeling various scenarios—such as the impact of tariffs, potential material shortages, or shifts in regional sourcing—companies can proactively build agile supply chains and make informed decisions that minimize the financial impact of disruptions, transforming potential threats into competitive advantages.

Regulatory Compliance & Software Integration Costs in Automotive Electronics

Modern automotive electronics are subject to stringent regulatory compliance requirements, which introduce significant cost complexities. Meeting demanding automotive standards, such as ISO 26262 for functional safety or ASPICE for software development processes, is non-negotiable but adds considerable time, effort, and cost to software development. Government regulations aimed at improving safety and reducing emissions have historically added significant costs to vehicles, accounting for a notable portion of overall price increases. For example, the Cyber Resilience Act (CRA) in Europe imposes substantial fines, up to €15 million, for non-compliance, highlighting the financial risks associated with inadequate adherence.

Beyond regulatory adherence, the inherent complexity of software integration within automotive electronics presents its own set of cost challenges. Automotive software is often developed in silos but must function as one integrated system, leading to issues like late feedback, expensive debugging cycles, and fragile, hardware-bound integration. This complexity is further compounded by the need for ongoing maintenance, security patches, and over-the-air (OTA) updates throughout the vehicle's lifecycle. Regulatory compliance, while essential, can become a significant cost multiplier if not managed strategically. Simply meeting minimum requirements is often insufficient; companies must embed "trustable software practices" and robust integration processes early in the design cycle to avoid massive downstream penalties, costly recalls, and irreversible erosion of customer trust. Should costing must therefore account for these compliance-driven costs and the intricate challenges of software integration from the outset, rather than treating them as afterthoughts.

Future of Electronics Costing: Advanced Techniques & AI for Automotive & EV

The evolution of technology is continuously transforming the capabilities of should costing, moving it beyond traditional spreadsheet-based methods towards more dynamic, predictive, and integrated approaches.

Automating Electronics Should Costing: Bulk & Matrix Costing

Product cost analysis, traditionally a manual and labor-intensive process reliant on spreadsheets, is being fundamentally reshaped by the advent of should cost process automation technologies. These advanced tools can now analyze manufacturability (DFM), calculate product costs, and even assess carbon emissions for hundreds or even thousands of components with minimal human interaction. This capability represents a significant leap from reactive, piece-by-piece analysis to proactive optimization at scale.

"Bulk costing" is a prime example of this automation, allowing for the rapid evaluation of numerous parts simultaneously. This frees up cost and value engineers, who are often overwhelmed by the volume of new part designs, to focus on more strategic initiatives rather than tedious manual calculations. Similarly, "matrix costing" enables the simulation of production scenarios in different geographical regions, taking into account all changes to regional economic variables such as labor rates and other real-world factors. By automating these complex calculations, organizations can analyze entire product assemblies or portfolios, identify cost drivers early in the design phase, and simulate the impact of changes at scale, thereby "baking in" profitability from the outset rather than attempting to cut costs later in the product lifecycle.

AI & Machine Learning in Predictive Electronics Cost Analysis

Artificial Intelligence (AI) and Machine Learning (ML) are poised to revolutionize should costing by enabling more sophisticated predictive analysis and dynamic pricing strategies. AI-powered predictive pricing software, for instance, can analyze comprehensive datasets in minutes to dynamically optimize prices, factoring in real-time market conditions, competitor pricing, and customer elasticity.

Beyond market-facing pricing, ML algorithms are increasingly used in predictive maintenance for complex electronic systems, such as EV charging infrastructure. By analyzing data from IoT sensors monitoring temperature, vibration, current, voltage, and humidity, these algorithms can predict when equipment is likely to fail or require maintenance. This proactive approach reduces maintenance costs, increases uptime, and improves safety, directly impacting the operational costs over a product's lifecycle. Furthermore, AI can streamline and guide the design and simulation of electronic components for automotive applications, helping to optimize performance and safety while managing thermal concerns and electromagnetic interference (EMI). This convergence of costing, design, and operational data, powered by AI, enables a continuous feedback loop where real-world performance data can inform future design iterations and cost models, leading to more robust products and optimized lifecycle costs. This holistic view moves should costing from a discrete activity to an integrated, continuous process across the entire product lifecycle.

Leveraging Digital Twins for Holistic Electronics Cost Optimization

The concept of a "digital twin" is central to the future of holistic cost optimization in electronics. While not always explicitly termed as such in all discussions, the underlying principle involves creating a virtual replica of a physical product and its manufacturing process. This digital twin connects 3D CAD models to a "digital factory," allowing for the simulation of real-world production processes and the evaluation of design decisions' impact on cost. This enables a shift from periodic cost estimation to continuous cost intelligence.

By having a living, breathing digital representation of a product and its manufacturing process, companies can constantly monitor, analyze, and optimize costs throughout the entire product lifecycle, from concept to end-of-life. This ensures that cost decisions are always based on the most current and accurate data, leading to sustained profitability and competitive advantage. The ability to track ideas, simulate changes, and provide real-time updates within this digital environment empowers organizations to continuously refine their cost models and identify new opportunities for savings.

xcPEP: Empowering Automotive Electronics Should Costing & Cost Reduction

Advanced Structures India's xcPEP platform represents a cutting-edge solution specifically designed to address the complexities of electronics should costing in the automotive, EV, and off-highway industries. It transforms traditional, often fragmented, costing processes into a unified, intelligent, and highly efficient workflow.

How xcPEP Transforms Electronics Should Costing: Unified Platform for Engineering & Sourcing

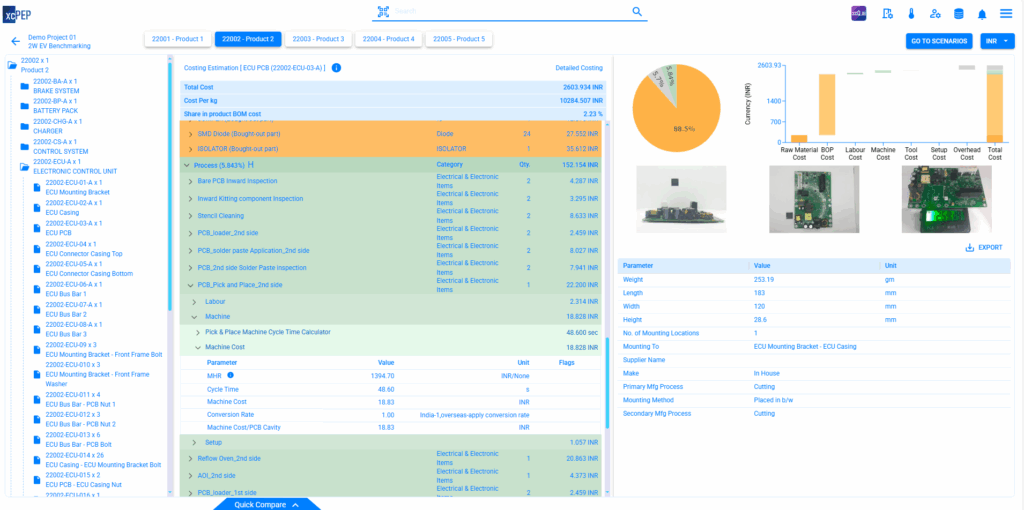

xcPEP is purpose-built for the intricate cost modeling of complex electronic products characterized by high part density and rapidly shifting sourcing variables. Unlike generic Bill of Materials (BOM) trackers or mere price aggregators, xcPEP employs a structured should costing methodology that simulates real-world production processes, enabling accurate and consistent cost estimation at both the part and system levels. This includes modeling tooling paths, intricate production processes, and realistic overheads, providing a depth of analysis that simpler tools cannot match.

A critical challenge in cost management within manufacturing organizations is the inherent disconnect between engineering teams (focused on design and functionality) and procurement teams (focused on sourcing and cost). This often leads to "inaccurate should-costing" and "scattered data across teams," hindering a unified view of cost drivers. xcPEP directly addresses this by providing a unified platform with an engineering-led approach and multi-team collaboration features. This bridges the gap between design and sourcing, ensuring that cost decisions are informed by technical realities and that procurement teams possess defensible, data-driven insights for negotiations, thereby fostering alignment and efficiency across the entire organization.

xcPEP Features & Benefits: AI-Powered BOM to Real-Time Cost Analysis

xcPEP offers a comprehensive suite of features that directly translate into tangible benefits for electronics should costing:

AI-Based PCB Component Identification: This feature automates the traditionally manual and error-prone process of identifying components on Printed Circuit Boards (PCBs). It automatically detects and classifies mounted components, populating BOM fields with high accuracy and significantly reducing manual effort and lead times.

Detailed BOM and Part-Level Parameter Mapping: The platform enables granular mapping of BOMs and part-level attributes directly from teardown studies or engineering drawings, providing the foundational data for precise cost models.

Configurable and Custom Cost Models: xcPEP provides structured, editable cost models built with manufacturing logic relevant to specific processes. Users can adjust inputs like material usage, cycle time, tool life, and labor effort to match internal standards or supplier conditions. For unique costing needs, the platform also allows users to build fully custom models from scratch.

xcPROC Integration: xcPEP connects directly to xcPROC, Advanced Structures India's continuously updated internal cost database. This integration provides consistent, live values for raw material prices, machine-hour rates, labor costs, and tooling norms, ensuring that cost models are always based on current market realities.

Scenario Simulation and Comparison: Users can create multiple scenarios for the same part or assembly by modifying key inputs such as production volume, material grade, process route, or supplier location. Each scenario is stored independently and can be compared using built-in tools, with graphical views that clearly show cost deltas and highlight key drivers. This capability enables proactive decision-making in design and sourcing.

In-Built Idea Tracker: A dedicated module within xcPEP captures and centralizes cost-saving ideas, recording proposal details, expected savings, source, and status. Users can simulate changes directly within the platform to evaluate the actual cost impact of these ideas.

Built-in Cost Dashboards: Integrated dashboards provide real-time visualization of cost breakdowns by part, process, material, and supplier. This allows users to quickly understand major cost drivers and monitor cost distribution as percentages or absolute values.

The cumulative benefits of these features are significant: xcPEP provides full transparency into calculations and inputs, helping teams defend decisions, align cross-functionally, and negotiate with confidence. It ensures real-world accuracy in part cost estimations, reducing reliance on static averages or external benchmarks. The platform significantly improves negotiation leverage by generating internal cost references and "fact packs" for supplier discussions. Furthermore, it digitizes and centralizes cost reduction efforts, allowing for systematic tracking and validation of savings. The strategic advantage of integrated cost intelligence offered by xcPEP is profound. By centralizing data, automating processes, and enabling real-time analysis and collaboration, it empowers organizations to move from fragmented, assumption-based costing to a data-driven, strategic approach. This integrated intelligence allows for faster, more accurate decision-making, leading to significant and defensible cost savings and a stronger competitive position.

Proven Impact: Real-World Electronics Cost Savings with xcPEP

The effectiveness of xcPEP is demonstrated through real-world applications. For instance, a motor controller teardown study conducted using the platform achieved a total cost saving of 9.3% for Controller A, with an impressive 41% of the generated ideas successfully implemented. This tangible outcome underscores xcPEP's capability in facilitating Value Analysis/Value Engineering (VA/VE) exercises and driving measurable cost reductions in complex electronic assemblies. Such figures highlight the significant Return on Investment (ROI) that advanced should costing methodologies and tools like xcPEP can deliver. It is not merely about incremental savings but potentially transformative reductions that directly impact profitability and competitiveness, especially in high-cost, high-volume sectors like automotive electronics.

Seamless Integration with xcPROC for Up-to-Date Electronics Cost Data

In industries characterized by rapid technological change and supply chain volatility, static cost data quickly becomes obsolete. The seamless integration of xcPEP with xcPROC, Advanced Structures India’s internal cost database, provides a crucial competitive advantage. xcPROC continuously tracks and updates live raw material prices (across steel, aluminum, copper, polymers, and specialty alloys), machine-hour rates, labor costs, and tooling norms. This ensures that all cost models within xcPEP are calculated using validated, current input values that reflect real-world manufacturing conditions. This real-time market intelligence allows companies to make agile, data-driven decisions that respond effectively to market shifts, ensuring that their cost models remain accurate and their sourcing strategies optimized for maximum efficiency and profitability.

Conclusion: Mastering Electronics Costs for Sustainable Innovation

The escalating complexity and cost of electronics in modern vehicles, encompassing automotive, EV, and off-highway sectors, underscore a fundamental truth: proactive should costing is no longer merely an option but a strategic imperative for Original Equipment Manufacturers (OEMs) and Tier-1 suppliers. This methodology is essential for shifting from reactive cost-cutting measures to a proactive approach focused on holistic value optimization throughout the product lifecycle.

The path forward for organizations lies in embracing advanced tools and methodologies that provide the necessary transparency, accuracy, and agility. This guide has highlighted the critical importance of detailed data acquisition, dynamic cost modeling, rigorous scenario analysis, and the strategic application of Design for Manufacturability (DFM) and Design for Assembly (DFA) principles. Furthermore, it has emphasized the transformative potential of automation, Artificial Intelligence (AI), and Machine Learning (ML) in enhancing predictive cost analysis and leveraging digital twins for continuous cost intelligence.

Platforms like xcPEP are instrumental in navigating these multifaceted complexities. By centralizing data, automating processes, and enabling real-time analysis and collaboration, xcPEP empowers organizations to move from fragmented, assumption-based costing to a data-driven, strategic approach. This integrated cost intelligence facilitates faster, more accurate decision-making, leading to significant and defensible cost savings, improved decision-making, better supplier relationships, faster time-to-market, and enhanced product quality. Mastering electronics should costing, particularly with advanced digital tools, is not merely a finance or procurement function; it is a strategic imperative that drives holistic business transformation. It enables organizations to innovate more sustainably, maintain profitability in fiercely competitive markets, and build resilient supply chains, ultimately securing long-term success in the rapidly evolving automotive, EV, and off-highway industries.